There are many popular life insurance companies out there that succeed in creating strong brand recognition through longevity, good marketing, and a solid product offer. Gerber Life Insurance Company is definitely one of those brands that have stood the test of time. If you weren’t familiar with them as a life insurance company, then you certainly are familiar with the famous Gerber baby logo. Gerber Life is just one of the many companies that we represent as an independent agency. Because we’re independent we get to review all the companies without having any bias towards any particular one. Plus we feel that shoving our opinions down your throat will not accomplish anything and you will be farther away from your best life insurance company. We say “your best life insurance company” because what is the best for one person may not be the same case for you since everyone has different needs, health, and lifestyles. We see them objectively and only favor those companies that have helped our clients, time and time again. So let’s review what Gerber Life has to offer in the life insurance marketplace. The following are some key points from this article;

- Gerber Life Insurance Company has a long past and is traced back to 1927.

- Gerber has two companies, one that provides baby food and they are also known as “the baby food people,” and their life insurance company.

- Gerber Life Insurance is licensed to provide life insurance throughout the United States, Canada, and Puerto Rico. Gerber has more than $45 billion of life insurance in force and helps provide financial security through over 3.3 million policies.

- Gerber Life Insurance offers term and whole life policies for adults as well as life insurance for children, a grow up plan, and college plan.

- Overall we like them because they are always competitive with guaranteed issue products and have a history of tremendous customer service. Gerber life insurance is a rare company that can be compared to both no exam and traditional life insurance carriers, so let’s see where it stands.

Gerber Life Insurance Company 2017 Review

Gerber Life Insurance Company has been around since 1967 and since then they have provided quality life insurance, especially for young families on a limited budget. If you haven’t heard of Gerber Life Insurance then you probably have seen their products, baby food, in many of your local stores. Gerber has two companies, one that provides baby food and they are also known as “the baby food people,” and their life insurance company. Gerber Life Insurance is licensed to provide life insurance throughout the United States, Canada, and Puerto Rico. Gerber has more than $45 billion of life insurance in force and helps provide financial security through over 3.3 million policies. Gerber Life Insurance offers term and whole life policies for adults as well as life insurance for children, a grow up plan, and college plan.

Gerber Life Insurance Company A.M Best rating

If you haven’t heard of A.M Best the Rating company then you will today! A.M Best Ratings Company is very well known when it comes to rating agencies, they are one of the top companies in that industry. According to A.M Best, they have rated Gerber Life an “A” or excellent. You should always read a company’s rating and we will go over why that is important.

Let’s say you’re a parent and you’re hiring a new nanny or new babysitter do you simply hire them because they are smiling and say they have ABC experience? I didn’t think so either, how about if you are hiring a new maid or handyman? I’m almost 100% positive that you want to check their references just to make sure they are the right fit. You should look at life insurance companies the same way. You are doing them a favor by buying a product of theirs and making an investment for future profits. Don’t be fooled, you are the key to their continued success. So how could you check up on a life insurance company’s references you ask? Ratings is the answer. Sometimes reading customer experience or complaints won’t be as accurate because you really don’t know what kind of policy they had and you would be surprised to know that most of the time it’s the customers fault for not reading the fine print or not sharing information on the application. That’s why we think it’s important for you to take a peek at a company’s rating. Rating agencies like A.M Best, Standard & Poor’s, Moody’s, and Fitch go through numerous of investigations before they share their fair rating. A good rating consists of an “A+”, “A”, “A-“, and if the rating goes lower than a “B” they are considered low. A company with a high rating implies that they are financially stable and more than capable of paying out your policy’s death benefit. A company with a low rating implied that they are NOT financially stable and they are vulnerable to any change around them. If there were a market crash the company with a low rating would fail miserably while the company with a good rating stands tall and strong. You don’t want to risk your family not getting your death benefit especially when they are mourning. Pick a company that has a great rating and don’t lose money with a bad rating company. If a company pulls out or files bankruptcy your policy will disappear and so will the premiums you were paying. We don’t want you to have a bad experience and that is why we take the time to share with you the importance of reading a company’s rating.

Gerber Life Products

The products a life insurance company offers are usually one of the biggest things that makes or breaks them. Gerber has a pretty good offering with their products and a few options to choose from. From term life, whole life, and even college savings plans let’s break them down.

Gerber Term Life Insurance

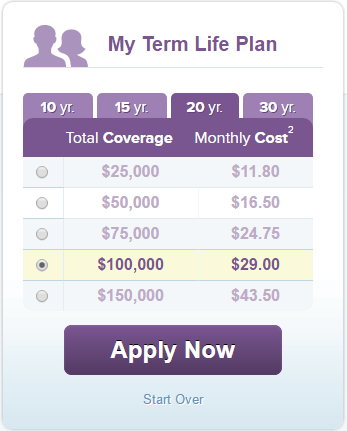

Gerber life insurance offers a term life insurance product for coverage amounts between $25,000 and $150,000. It is a level term product that means your premium will not go up or down during the entire term period. If you are 18 to 50 years of age and seek coverage of up to $100,000 then you will not be required to take a medical exam. All you would have to do is answer some health questions on the application and if they check out as true, you are approved. The term lengths available are 10, 15, 20 or 30 years of coverage. Now as you may or may not know, once your term period ends your coverage is set to expire. With this Gerber term life policy, you can choose to either let it expire or to convert it to a permanent life insurance policy. You will be able to convert it without proving good health. Your rate will simply be adjusted to your older age. This is a great option if you still feel you need coverage and your health has taken a turn over the years.

Gerber Whole Life Insurance

The Whole Life offer with Gerber is very similar to their Term Life offer. The biggest difference is that this a permanent life insurance product that builds cash value, vs a temporary one that does not. While I personally don’t think cash value is for everyone, and in most cases too expensive, this is an option with Gerber Life. You can get $10,000 to $150,000 in coverage and are able to skip the medical exam if you are 18 to 50 years of age and seeking only up to $100,000 in life insurance. It does build cash value if you hold on to the policy long enough Which means that you can borrow against the policy in the future.

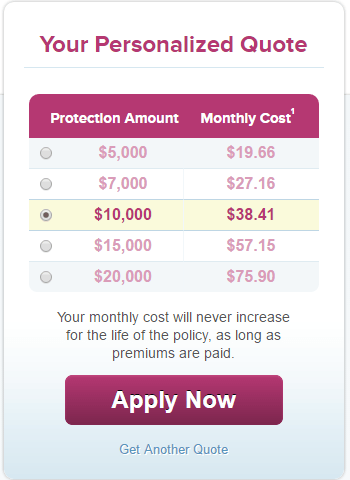

Gerber Life Guaranteed Issue

It’s arguable that this is one of the most popular products by Gerber Life and they are extremely competitive with other guaranteed issue life insurance companies out there. This plan does what is says in the name, it provides life insurance on guaranteed basis, no questions asked. There is no medical exam to take, no heath questions to answer, you are guaranteed coverage. The requirement is that you are between the ages of 50 and 80 years of age and seeking $5,000 to $25,000 in coverage. You are automatically approved for this policy regardless of health.

Gerber Life Accidental Protection

This is an accidental insurance policy with coverage amounts between $20,000 and $100,000. This is protection against an accidental death or one of the covered injuries in the policy details. Keep in mind this isn’t an all cause life insurance policy, only if the death is the cause of an accident. The rates are locked in for life, they will not go up or down. The coverage is also issued on a guaranteed basis regardless of health or occupation.

Gerber Life Insurance for Children

Gerber Life also offers life insurance for children. One of them is college savings plan that provides life insurance protection and a savings component. The other is a whole life insurance policy that they can convert to their own policy at age 21. Both of these are unnecessary in my professional opinion. There are much better ways to invest money for your child’s future without having to pay for the life insurance portion of it. However, if you would like more details you can visit their site here.

Coverage Amount

Overall Gerber has good life insurance products and is a great company in itself. However, my biggest complaint is the coverage amounts. Whether we are talking strictly no exam companies or all traditional term life insurance companies. Their caps with a term and permanent coverage are $150,000 with most no exams capping at $250,000 and a few at $400,000. Traditional exam plans can go up to any amount that is reasonable.

Application

Gerber decided to specialize in a more streamlined application process that requires no exam for most clients. After your agent asks your typical needs analysis questions it will be time for a short application with a few health questions. Overall, it’s basically a no exam carrier. So how does it compare to some of the no exam products on the market?

There is no medical exam so it speeds up the underwriting by a lot. Typically, you would have to wait for 6 to 8 weeks for the underwriter to come back with a decision. With Gerber, you are approved if you can answer the health questions.

Cost

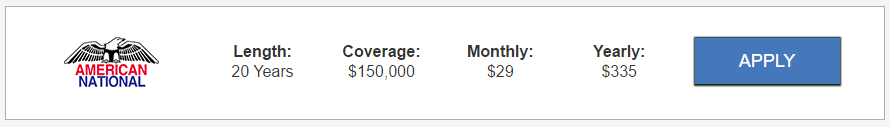

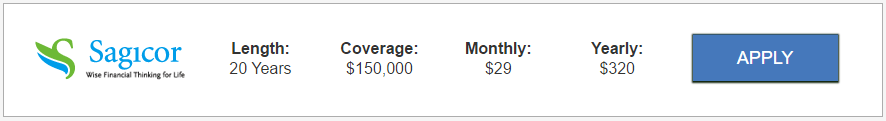

When it comes to cost for their no exam term life insurance then they aren’t quite competitive because their underwriting is more lenient than most no exam companies out there. Here is an example of some quotes.

As you can see you get $50,000 more in life insurance for the same cost with other companies that offer no exam.

As you can see you get $50,000 more in life insurance for the same cost with other companies that offer no exam.

However, when it comes to Guaranteed Issue, Gerber Life is always competitive with their rates, here is sample quote below for their guaranteed plan.

Is Gerber Life Insurance a good company?

Gerber Life Insurance is a great life insurance company that has strong brand recognition and great product offering. Overall we like them because they are always competitive with guaranteed issue products and have a history of tremendous customer service. Gerber life insurance is a rare company that can be compared to both no exam and traditional life insurance carriers, so let’s see where it stands. As an independent agency, Gerber Life isn’t a company we would hesitate to recommend. Here is what their customers rated them on their website.

Start Here

Despite Gerber being a great company, life insurance needs aren’t one size fits all. Each person may have a different company that would be better for them and not for others. Because we are an independent agency we have the ability to shop with all of the companies to get you the best rate at no extra cost to you. If you have any questions about Gerber life insurance or want to compare rates, simply give us a call at 888-492-1967 or hit the chat button below. Welcome to InsureChance!