The difficulty of getting life insurance with a mental illness will depend on the experience of the life insurance agent you ask. An inexperienced agent will either say that it’s impossible while another will say it’s all sunshine and rainbows. The truth is, like any illness and life insurance, it will all depend on the type/severity of the condition, and most importantly the company that you apply with. Simply running quotes online won’t help because each company weighs certain risks differently so if you want to shop around for coverage reach out to us so we can do the shopping for you. Otherwise let’s look into a few factors when it comes to getting coverage with a mental illness.

Weighing the Risk

The life insurance companies will look at a few things when judging what rate to give you. The first of which is the type of mental illness. Usually things like anxiety and depression aren’t viewed as potentially harmful as long as they don’t interfere with everyday life. So if you’re active and working you should be able to get coverage at a fairly good rate as long as all other factors are well. With a mental illness such as bipolar disorder you will be rated much higher.

The second thing they will look at, is the severity of the mental illness. Usually rated from mild, moderate, to severe. Severe being the biggest cause for concern and can result in a really high rating or a decline depending on the company. Severe usually includes things like being disabled and or recently hospitalized with numerous episodes in a recent amount of time. As aforementioned, if you are living an active, social life it will be no issues getting coverage. If however, the illness is getting in the way of daily life, you will be rated up.

The third thing the life insurance companies will look at are all the factors outside of your mental illness. This includes your physical health, lifestyle habits(like smoking) and what you’re doing to get better. Treatment is a very big factor in their underwriting process so it’s important that you can prove that you are taking actionable steps to get better. A good agent(call us) will be able to help you with this process.

A Breakdown

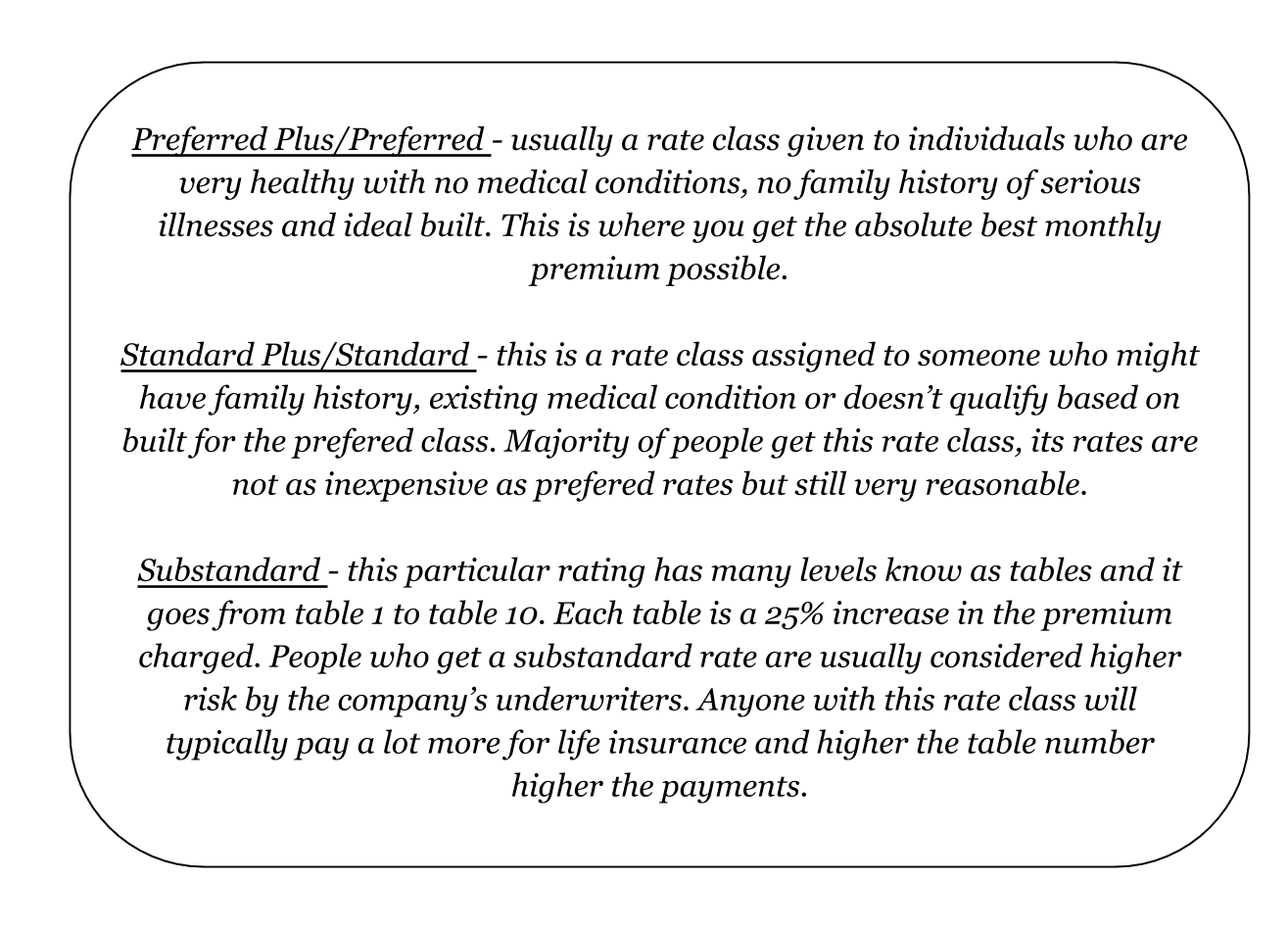

While reading about rates and severity you may be left a little confused so here is a simplified breakdown of how they measure severity and rates.

Mild – To be considered as having a mild mental illness means you’re a working individual with an active social life and a support system. If your condition is under control and you haven’t been hospitalized than you can expect a Preferred – Standard rating.

Moderate – If you’ve had a few episodes in the past but are undergoing successful treatment but with no suicide and hospitalization you are considered moderate. For this you can expect to receive substandard rates.

Severe – If you are on disability and have been hospitalized then you will most likely fall into the severe category. For this you will either get the highest rating or declined for coverage, which will leave a guaranteed issue life insurance policy as your option.

Wrapping Up

In the end there is no need to be worried. Getting coverage will all come down to taking the right steps, which is what we specialize in. We work with all of the companies on the market and work closely with our underwriters to know which company will favor your condition. Give us a call today at 888-492-1967 or hit the chat button below and let us answer any and all your questions.