You decided to get a life insurance policy after putting it off for a while because you didn’t have one or you needed to get more coverage. Now somehow you ended up on National Western Life maybe through a friend or an agent and you’re curious to find out if this is a good or bad company. What you’ll be surprised to find out that there are a lot of different factors to consider when evaluating life insurers. You need to know how long they been around, how are they rated, what are their financials, how are their products and what do other people say about them. After, you get all that figured out it leaves you with the most important question of them all, “Are they the best option for me?

You decided to get a life insurance policy after putting it off for a while because you didn’t have one or you needed to get more coverage. Now somehow you ended up on National Western Life maybe through a friend or an agent and you’re curious to find out if this is a good or bad company. What you’ll be surprised to find out that there are a lot of different factors to consider when evaluating life insurers. You need to know how long they been around, how are they rated, what are their financials, how are their products and what do other people say about them. After, you get all that figured out it leaves you with the most important question of them all, “Are they the best option for me?

When it comes to life insurance there is no such thing as one company that’s perfect for everybody. A life insurer uses a lot of factors to determine your eligibility so what’s best for one person might not be the best for another. This is the exact same reason why we work with over 60 companies and don’t understand when an agent represents only one or two. But you’re here to find out if this is the best choice and that’s what will do.

Quick Note: By no means, I think National Western is the best choice for you if you’re in great or good health. There are bigger companies with more competitive rates that you can get if your health is not an issue. If this is the case check out some life insurance quotes, otherwise keep on reading.

About National Western Life

This company was started back in 1956 with a mission to provide quality insurance products and to operate globally. This company is more than 60 years of age but keep in mind that other large insurers are 100 plus years of age so this is quite normal. The company is headquartered in Austin, TX but obviously has offices all over the country and the globe. National Western focuses on selling primarily life insurance and annuities which I like because it is good to work with companies that specialize since they have a better feel of designing products that consumers want.

Now, as far as their financial strength they have an “A” rating from A.M. Best which is pretty good and means that they have a sufficient amount of reserves to pay out claims if there were a large number of claims. This rating method saves you from turning into a forensic account because rating agencies like A.M. Best, S&P and Moody’s do that for us. This company did close to $700 million in 2016 in business so not bad but not great when you compare them to $50+ billion that large life insurers that we represent do. The point here is not to talk them down but to give you an understanding of the scale so you can look at the facts and not the hype most agents sell.

We also did some browsing to see what customers had to say about this company and there really were very few complaints. This simply shows you that the company is definitely not out to scam people because when that’s the case you’ll have 1000’s of angry clients screaming and warning others. They also have an “A+” rating from the Better Business Bureau which shows you that they resolve complaints and don’t have too many derogatory remarks on their profile.

Products of NWL

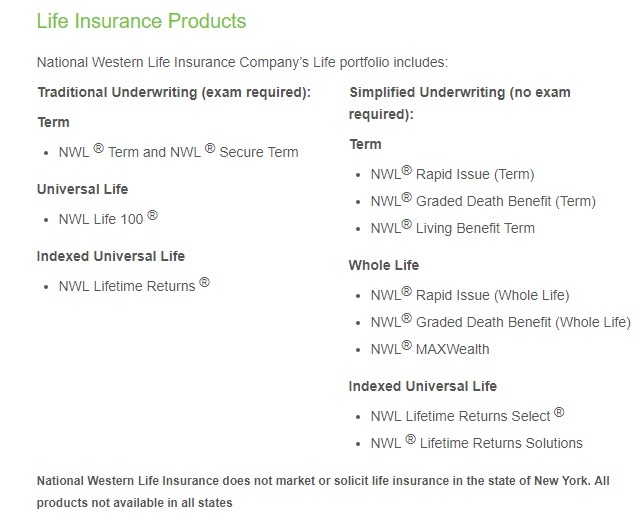

National Western has a wide range of life insurance products for you to choose from but you’ll notice that they have way more simplified issue options so you can get a policy without having to take a medical exam. Here is a screenshot from their website that lists all of their products but we’re just going to summarize the different categories so you understand what they offer.

Traditional

A traditional plan is simply one with a full underwriting process. Now, what is a full underwriting process? It is when the company wants you to fill up the application with answering 40+ questions, completing your medical exam and checking all your records. They may also ask for additional questionnaires or reports depending on their initial finding. With traditional plans, you’re looking at 3 to 5 weeks before you get approved. Most plans in the marketplace are set up this way. National Western only has 3 traditional plans one is a temporary term life insurance plan and the other two are permanent universal life plans.

Simplified Issue

This is similar to a traditional plan but it eliminates a few steps from the underwriting process. These plans are known as no medical exam plan and you can get approved without needles or long wait times. However, they will still ask you questions and may check your records. This doesn’t mean that you should apply for a simplified issue if you’re in bad health. National Western is a very strong player in this market as they have way more simplified issue plans than traditional. So if you’re looking for a convenient way to secure a life insurance policy whether it’s term or permanent this is the way for you to do it.

Graded Death Benefit

If you haven’t been able to secure a life insurance policy this is probably where National Western Life can really help. They offer some graded death benefit plans which have no underwriting just ask you few questions which are addressed towards severe conditions. Almost anyone can qualify for this plan but there is a catch. If you die within the first 3 years the company has a gradual percentage payout like 30% first year, 60% third and so forth until it pays 100% in year 4.

Summary

Overall like most reviews, this one has both some good and some bad points that we must acknowledge. Some of the good points are that the company has a high financial rating. They also have very few bad reviews which means that you won’t be mistreated by National Western Life. Another thing is that if you have the need for a no exam plan or can’t qualify for coverage due to health conditions they have a strong niche in that. So, in essence, their products are pretty great.

What we didn’t like is that they are a much smaller company than what we usually recommend to our clients. The reason this is a concern is that if they have a large number of claims they have a greater risk of going under than let’s say Prudential. Besides their size, the company is pretty solid but we still believe you may do much better if you shop around and if you don’t at least you know you’re getting the best you deserve.

Work with InsureChance!

I really hope you have enjoyed our review of National Western Life. As you can see they are a solid company with a bright future ahead of them with a cool line up of products. It doesn’t matter what company we review I always advise you to shop around to see what else is out there. This is the reason we created our website to offer actual quotes with over 60 top rated companies and a no sales pressure client support team. If you’re ready to work with the best life insurance agency online simply request an application or call us at 888.492.1967!