You are on a hunt for a life insurance policy and are wondering if Pacific Life is a right choice to protect your loved ones. You may have heard about Pacific Life on TV or online or maybe just saw their logo (the breaching whale). If you didn’t don’t worry, that’s what we are here for! You should want to find the best policy for the best value and in some aspects, this company might be right for you and your family. Look no further, this article was created to help you understand the company and to make your life a little simpler when it comes to life insurance. Some quick pointers about the company and important highlights of this article:

- Pacific Life was founded by a U.S Senator from California, named Leland Stanford in 1868.

- Pacific Life Insurance is very highly rated and was rated A+ (superior) by A.M Best.

- This company is recommended for its stability; they have been around for more than 140 years.

- In the past 32 years, Pacific has donated $96 Million! They donated over $1.7 Million in grants to Southern California Nonprofits.

- Pacific Life offers a good variety of products for customers such as Term Life Insurance, Variable Universal Life Insurance, Indexed Universal Life Insurance, Universal Life Insurance, Life Insurance Riders, Mutual Funds, and Annuities

- They offer 2 term life insurance policies; Prime Term Life Insurance & Pacific-ART Term Insurance.

- You can also purchase additional riders such as a Waiver of Premium and Accelerated Death Benefit.

- Permanent life insurance is perfect if you’re looking for a long term coverage since they’re designed and priced for you to keep that coverage for over a long period of time.

- Pacific Life’s Universal life insurance products are the following; Versa-Flex PRO II-CV, Versa- Flex NLG, Pacific Estate Preserver III, and Pacific Prime UL-NLG.

- Universal Indexed Life Insurance Products; PIA Protector, Indexed Pacific Estate Preserver, Pacific Indexed Performer LT, and Pacific Indexed Accumulator 4

- Variable Universal Life Insurance Products; Pacific Select VUL, Pacific Prime VUL, Pacific Select Survivorship VUL.

- There are two types of life insurance to consider when shopping for life insurance and that’s term life, and cash value life (whole, universal, and variable).

- The application process consists of 4 steps; Compare quotes, Application process, scheduled medical exam, and the final decision of the company (regarding rates).

Pacific Life History

Pacific Life was founded by a U.S Senator from California, named Leland Stanford in 1868. He founded Leland Stanford, Jr. University (which is also known today as Stanford University) as a memorial to his only son and was also the first life insurance policyholder from Pacific Life. They offered life insurance at their initial offering, but in 1885, they also added accident insurance to their products list. The company was reorganized in 1936, to help fix financial losses associated with the Great Depression. Pacific Life has so much history and yet they still managed to keep its current position as one of the leading life insurance providers in the nation. Another 20 years passed and the company merged with another company named Conservative Life, for a greater size and a bigger impact on the local markets. In 1997, the company rebranded itself from Pacific Mutual to Pacific Life Insurance, which means that the company changed from mutual ownership to a mutual holding company. Pacific Life Insurance sells its products in all of the country’s 50 states.

Pacific Life Rating and Review

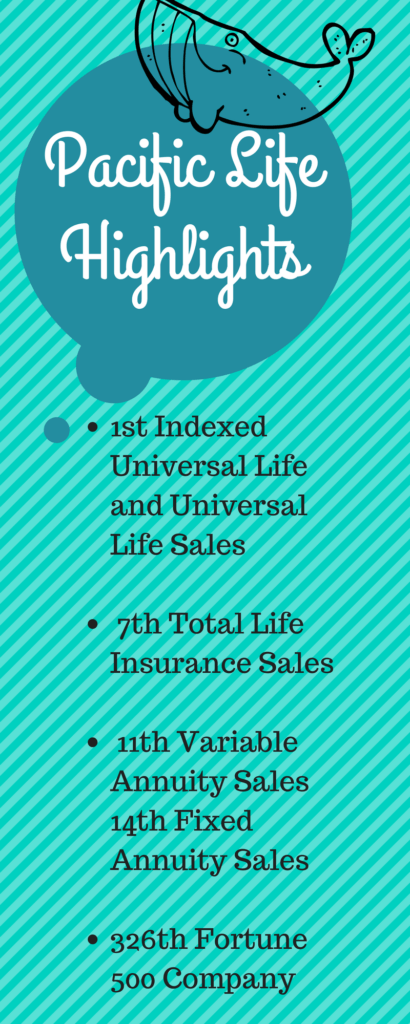

As you can see from the image that Pacific Life Insurance is very highly rated and was rated A+ (superior) by A.M Best. Pacific Life was #1 in indexed universal life insurance in 2010-2012. This company is recommended for its stability; they have been around for more than 140 years. Today the company is one of the nation’s largest insurance companies and ranked 369th largest corporation in America. Pacific Life offers one of the lowest term life insurance rates in the nation, smokers are included. They grew into a multi-faceted financial company and its parent company, Pacific Mutual Holding Company, had $123.7 billion in total assets in 2012. Pacific Life’s logo (breaching whale) embodies strength, high performance, and consistency. Pacific Life is one of the many “A” rated companies we offer since we only offer the very best rated companies here at InsureChance.

Figure 1 “Insurance Ratings.” Home. N.p., n.d. Web. 03 Mar. 2017.

Charities

Pacific Life has always believed in giving and they have shown their charitable efforts in communities and nationally. In the past 32 years, Pacific has donated $96 Million! They donated over $1.7 Million in grants to Southern California Nonprofits, and since 2014 they have built six KaBOOM! playgrounds for the disadvantaged youth. Pacific Life donated more than 5 ½ Million dollars towards Red Cross, Meals on Wheels, Conservation International for the Ocean Health, and United Way.

Pacific Life Insurance Products

Pacific Life offers a nice pool of plans for customers such as Term Life Insurance, Variable Universal Life Insurance, Indexed Universal Life Insurance, Universal Life Insurance, Life Insurance Riders, Mutual Funds, and Annuities

Prime Term Life Insurance

- This insurance has a choice of 10-year level term life, 15-year level term life, 20-year level term life, or 30-year level term life premium periods.

- Has annual renewable coverage up to age 95. Streamlined application and underwriting process.

- Conversion provision with a credit of up to one year of annualized term insurance premiums applied to cash value life insurance policy.

- Has Riders for disability and terminal illness.

Pacific-ART Term Insurance

- Perfect for those looking for short term coverage.

- Every year the policy is renewable, and the insurer has the option of getting a medical exam or not.

- Rates are recalculated each year and getting a clean bill of health can keep the cost lower.

Pacific Life Insurance Riders

When you purchase any Prime Term Policy, you can also purchase additional riders such as a Waiver of Premium which is a clause in an insurance policy that waives your obligation to pay any further premiums if you become seriously ill or disabled. After 180 waiting day period, you will be protected by this add-on rider policy. There is also another rider under Pacific Life and that’s an Accelerated Death Benefit, which you can add to your Prime Term policy at no cost! This allows access to 75% of your death benefits if you receive a diagnosis for a qualifying terminal illness.

Pacific Life & Permanent Life

What is permanent life insurance? It provides lifelong protection and has the ability to accumulate cash value on a tax-deferred basis. What differentiates permanent and term insurance is a permanent insurance policy will remain in force for as long as you continue to pay your premiums. Permanent life insurance is perfect if you’re looking for a long term coverage since they’re designed and priced for you to keep that coverage for over a long period of time. These policies are ideal if you have already maxed out your 401(k) or IRA and if you have an estate or even a high-income bracket. It is important to talk to an experienced independent life insurance agent before you invest your hard earned money on a permanent life policy. InsureChance can guide you to the best policy and rates and make everything in life a little simpler.

Universal Life Insurance Products:

Versa-Flex PRO II-CV

- You can adjust the amount of each premium payment based on your policy’s death benefit. (Min $50 premium payment)

- 2 basic coverage’s; Basic coverage type CV, & Annual Renewable term rider

- Cash value withdrawals available after the 1st year.

Versa- Flex NLG

- Death benefit protection for your family.

- Tax-free death benefit.

- Business continuity planning.

- Cash value potential for supplemental income.

- Adjustable death benefit.

- 3% guaranteed interest rate credited to your accumulated value annually.

Pacific Estate Preserver III

- Choose premium amounts to fit the budget.

- Adjustable death benefit.

- Benefit from built-in and optional riders that can enhance and protect your policy’s accumulated value and death benefit.

Pacific Prime UL-NLG

- No-Lapse guarantee duration’s up to a lifetime.

- Guaranteed interest crediting rates.

- Flexible premiums.

- Tax-free death benefit.

- Tax-deferred growth of cash value.

What is universal life insurance?

This is another permanent plan that will provide lifetime cover. What makes it different is that you have more flexibility than a whole life plan and a higher upside for interest returns.

Universal Indexed Life Insurance Products

PIA Protector

- Choose your death benefit amount and payout structure.

- Flexible premium amount within policy limits.

- Allocate the policy’s cash value among your choice of a fixed account.

- Flexibility cash value.

Indexed Pacific Estate Preserver

- Five indexed accounts, each with minimum interest crediting rate.

- Estate preservation rider-pays additional death benefit if both insureds die within the first four years.

Pacific Indexed Accumulator 4

- Adjustable premiums and life insurance coverage.

- Minimum crediting rates.

- Guarantee your policy stays in force regardless of policy performance.

- Dynamic policy access provisions, including an Alternate Loan option to boost your income potential.

Variable Universal Life Insurance Products

Pacific Select VUL

- Death benefit protection.

- Broad investment choices.

- Downside protection guarantees make it stand out.

- Income tax-free death benefit.

- Tax-deferred cash value growth potential.

- Tax-free supplemental income potential.

Pacific Prime VUL

- Flexible premiums.

- Flexible death benefit options.

- Increase or decrease the policy’s total face amount.

- You can change the beneficiary and investment options.

Pacific Select Survivorship VUL

- Cost effective coverage for two lives, especially when one life is uninsurable.

- Flexible benefits while living which include supplemental income and benefits for the survivor.

- Option to extend your guaranteed coverage with the No-Lapse Guarantee Rider.

Final Thoughts

As you read before, Pacific Life Insurance is a very stable insurance company, with over 145 years of experience, that offers a lot of products for different sorts of people. They have an A+ rating for A.M Better, and over $137 billion in assets. Although Pacific Life is an extraordinary company on the books with their assets, experience, and charities, but maybe their product line doesn’t fit well for you and your family, but don’t worry here at InsureChance Inc. we work with over 60 top rated life insurers to find you the best rate and plan based on your individual circumstances. It is always important to shop around with a big decision like life insurance and let our agents help you put your mind at ease and get back to enjoying your life! Not only do we do all the dirty work in the back we also guarantee a lifetime support so if you ever need to make any changes to your policy or have any questions you can always contact us! Call us at 888-492-1967, welcome to InsureChance!