You know you need to secure a life insurance policy and know that a term policy is a way to go since its affordable and easy to understand but you are a frugal person and hate the idea that if you outlive the term your premiums are forever gone.

You know you need to secure a life insurance policy and know that a term policy is a way to go since its affordable and easy to understand but you are a frugal person and hate the idea that if you outlive the term your premiums are forever gone.

Well, you are not the only one who thought about this and back in the early 90’s life insurance companies introduced an add-on to term plans known as Return of Premium. This was a perfect solution for individuals who wanted to get all the money they paid in if they outlived the term.

However, like anything else that sounds really good, there are downfalls to this. So let’s cover everything you need to know about Return of Premium Life Insurance.

Summary:

- Return of Premium is a rider aka an add-on to a term life insurance policy.

- Not all companies offer this rider with their term life insurance policies.

- The premium with this type of policy is more than double in comparison to a regular term policy. (sometimes triple)

- You’ll have to keep the entire term to get the premiums back which is usually for 20 or 30 years. So if you have a financial difficulty and policy lapses you lose a lot more money.

- It may be ideal if you’re getting this policy for business purposes and get a nice cash back at the end of the term.

- Before going with the return of premium policy it is important to check if you would fare better with alternative investments.

- Sometimes an Indexed Universal Life or Variable Universal life can offer accumulation and life insurance at a little higher cost than a Return of Premium plan but with more benefits.

If this is good enough for you feel free to compare different plans with our quote engine or call us at 888.492.1967, otherwise read on for in-depth info.

What is Return of Premium?

Return of premium term life insurance is simply a term life insurance policy rider that gives you all the premiums you paid out back if you outlive the term. This can be a great benefit if you hate the idea of paying for coverage for 5 to 30 years and not see anything in return if you outlive the term. We call this coverage ROP Term and a lot of people ask about it but not many go with it due to the coverage costing more than double of a regular term life insurance policy for the same amount of protection. If you Google return of premium life insurance you will notice a lot of strong one-sided opinions, some people are on the side of investing that difference while others think it’s a no-brainer to get free life insurance so to speak. Of course, we believe that this option has its cons and pros which we will discuss later, at the end it all comes down to each individual’s situation and need.

Many individuals that purchase this policy for individual family protection see as either way they will get their money. One way is if they die during the term and their beneficiaries collect the large death benefit. (least favorable option for most) However, if they outlive the term they will simply get a check which can be viewed as under the mattress savings since you won’t get any interest on the money. You should know that the reason the company charges so much more is they are actually investing the difference in the markets and making returns so they can easily pay you back and still stay in the green.

Wondering why you shouldn’t do that yourself? You should!

If you are a business owner and want to buy a life insurance policy on the key employee which will provide a death benefit until that employees retirement then Return of Premium Term might be a great option since you will just get all your money back if the loss of life didn’t occur and your valuable employee retires. Now if you are an active investor than paying double for a term policy won’t make sense to you since you most likely can use the difference to get returns which will be greater than the money you will receive at the end of the term. Even though it seems like you are not losing anything there is the opportunity cost of using that difference.

Now considering you are a hardworking American and have the ability to pay the premium then the return of premium life insurance is worthy option since you are getting a life insurance protection at technically no cost other than as we mentioned before, investing and getting greater returns. Personally, here at InsureChance, we recommend you get a pure term and invest the rest.

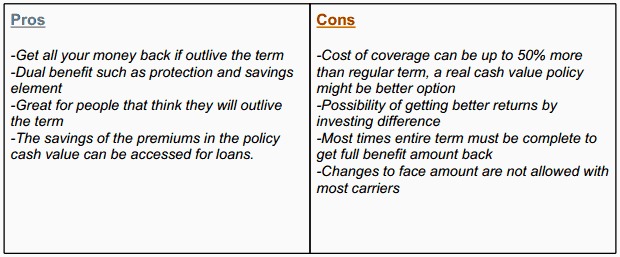

Pros and Cons of Return of Premium Life Insurance:

Hopefully, this chart will help you understand better whether this is the right plan for you. Some precautions to take are obviously not to get a ROP Term with premiums high enough to create a burden of paying them in the future. Because you would not get back the full amount you paid into the policy if it lapses prior to the term completion. Also, picture yourself at the end of your 10 or 30-year term policy and ask yourself what you can do with this money. Whether you can use it to help pay your child’s college or use it to pay some premiums of a permanent life insurance. If you are more concerned about providing a death benefit and see insurance as a risk transfer then you should just buy a term policy without the return of premium add-on.

The final scoop is that life insurance companies use the extra premiums they charge to invest which leads to great returns for them, so they can in exchange give you back your premiums and not go bankrupt with higher risk. In addition, from our client base data, we have sold a minuscule amount of return of premium term life which we believe is due to the fact that regular term life insurance provides protection against death with a low monthly payment most people can easily afford. Return of premium life insurance has its place but to look at regular term life insurance as throwing money away is silly since the peace of mind and security of your family is priceless. At the end of the day, the best kind of insurance policy is the one that is in force.

Here is a rate comparison for a $1,000,000 30 Year Term Policy for Traditional Term vs. Return of Premium Term for a 35-Year Old Male:

30-Year Term Life Policy (Pure Protection No Return)- Best quote $66.50/mo with Foresters Life Insurance Company.

30-Year Term Life ROP (Premiums Refunded at End)- Best quote $158.34/mo with Assurity Life Insurance Company.

Ouch, the difference is shocking! When it comes to life insurance you need to get something that you can easily every month. The higher the premium the more likely you will let the policy lapse if you have a rough couple of months.

Besides, if you took that $1102.08 annual difference and dumped it into an Index Fund for S&P 500 which has been averaging 10% since its inception you’d have about $200,000 versus $57,024 you’d get with a return of premium life insurance.

Alternatives to Return of Premium Life Insurance

Now if you’re an investment minded individual there are other ways to go besides a ROP Term. One way is to simply get a traditional term life insurance policy for dirt cheap and invest the difference into an index fund with Vanguard or another financial institution. The idea here is that at the end of your term you should have more money than you would get from a ROP Term. In fact, this is usually what most of our clients do since it makes more financial sense.

Another option is to consider a cash value based life insurance policy where you can get protection and tax-sheltered returns. Personally, we are not big into mixing life insurance with investment option but there are some circumstances where it can make sense. For example, if you are an investor who maximized all the tax benefit investments like 401k or Roth IRA then an Indexed Universal Life or Variable Universal Life Policy will make more sense. In other words, if you’re going to pay a fortune for life insurance get a better policy.

In fact, one of my recommendations for my clients is to simply buy a Guaranteed Universal Life plan that will provide lifetime protection and you’ll know for sure that you will leave a lump sum to your family at one point or another. The reason this plan makes so much sense is that it cost’s about the same as a ROP Term but provides a lifelong insurance protection. It also accumulates some cash value which you can access at future date for small emergencies.

Final Verdict

As a professional in the insurance and financial services industry, I personally can’t with a clear conscience say that Return of Premium Life Insurance is worth it. Whether you invest the huge difference or just use it to take your family out to dinner once a month it is better than giving almost 3 times more money just so they can use it for 20 and 30 years and give it back to you with no returns, let’s also not forget about inflation.

Besides, as mentioned before when premiums are high you’re more likely to lose the policy when you have financial difficulties. And in the event that you can easily afford a Return of Premium Term, you should simply buy a permanent life insurance plan like Guaranteed Universal Life since it will provide protection up to age 121, which is a real return of premium since you’ll leverage your money.

Work with Us!

When is all said and done if you’re a middle-class American you need to stay away from Return of Premium life insurance since it costs a lot. Even if you can afford it there a ton of other life insurance options that may better suit you. That’s why you should work with an independent agency that has the experience and options to provide you with the best option. Here at InsureChance, we work with over 60 top rated life insurers to get you the best rate. We will also assess your needs and consult you on what will be the best option. If you have any questions feel free to call us at 888-492-1967 or get your term life insurance quotes here.