You probably stumbled across this article because you are in the military, or your loved ones are in the military, or maybe you want to convert from your SGLI into VGLI but before you convert you want to learn more about VGLI Life Insurance. Here at InsureChance, we provide the most unbiased, informative articles out there so that you can come to your own conclusions.The following are some highlights of this article;

- VGLI Life Insurance stands for Veterans’ Group Life Insurance.

- If you are an active military personnel and are planning on retiring you have the option of converting your SGLI or Servicemembers Group Life Insurance into Veterans’ Group Life Insurance.

- There is a deadline for applying for this type of insurance, you have a year and one hundred and twenty days to apply.

- As long as you pay your monthly or yearly premiums you will have lifetime coverage and you may be able to enroll for a maximum amount of coverage that can be equal to the amount of Servicemembers’ Group Life Insurance coverage that you had before.

- The first advantage that VGLI offers is that if you are an eligible veteran then there is no way you will be turned down.

- VGLI premium rates are equal for both female and male.

- If you are a smoker then more than likely you will be charged with tobacco rates in any other policy but not VGLI. They provide one of best rates for smokers.

- VGLI has NO suicide exclusion so in a case of suicide, your beneficiaries will receive your death benefits.

- The last advantage the VGLI offers is the Terminal Illness Rider.

- A big downfall about getting VGLI or converting your coverage to a VGLI policy is that when you retire or turn 75 years old your premiums are very likely to double.

- You cannot build any cash value on this type of insurance.

- There are only seventeen companies that you can receive VGLI coverage from.

- It is very important for a company to have a fantastic rating such as AA+, A+, or even an A- because these ratings show how stable the company is with their financials and it also reassures the consumers that their money isn’t going to complete waste.

- In conclusion, VGLI may be a good idea if you have a medical condition, are a smoker, have bad health. If you have amazing health and are not a smoker you may have a better life insurance product with better rates than VGLI available.

- There are always options out there for everyone of all sorts of lifestyles and health.

What is VGLI Life Insurance?

VGLI Life Insurance stands for Veterans’ Group Life Insurance. If you are an active military personnel and are planning on retiring you have the option of converting your SGLI or Servicemembers Group Life Insurance into Veterans’ Group Life Insurance.

VGLI Eligibility

In order to apply for benefits of VGLI, you have to be eligible and had SGLI. There is a deadline for applying for this type of insurance, you have a year and one hundred and twenty days to apply. However, there will be no health questions asked if you apply within the first 240 days. You have to have been released from active duty or active duty for training under a call, but this can not be for a period of fewer than thirty-one days. Or you have retired or even if you have been put in placement on the Temporary Disability Retirement List. You can also be eligible to apply for VGLI if you had a part-time SGLI and while you were in duty you suffered an injury or even a disability and are uninsurable.

VGLI Coverage

You can continue your life insurance coverage after you separate from service with Veterans’ Group Life Insurance. As long as you pay your monthly or yearly premiums you will have lifetime coverage and you may be able to enroll for a maximum amount of coverage that can be equal to the amount of Servicemembers’ Group Life Insurance coverage that you had before. The good news is that once you have enrolled in VGLI, you will be able to increase your coverage by $25,000 every five years until age 60 with the maximum of $400,000 legislated with no proof of good health necessary.

VGLI Pros

- The first advantage that VGLI offers is that if you are an eligible veteran then there is no way you will be turned down.

- VGLI premium rates are equal for both female and male.

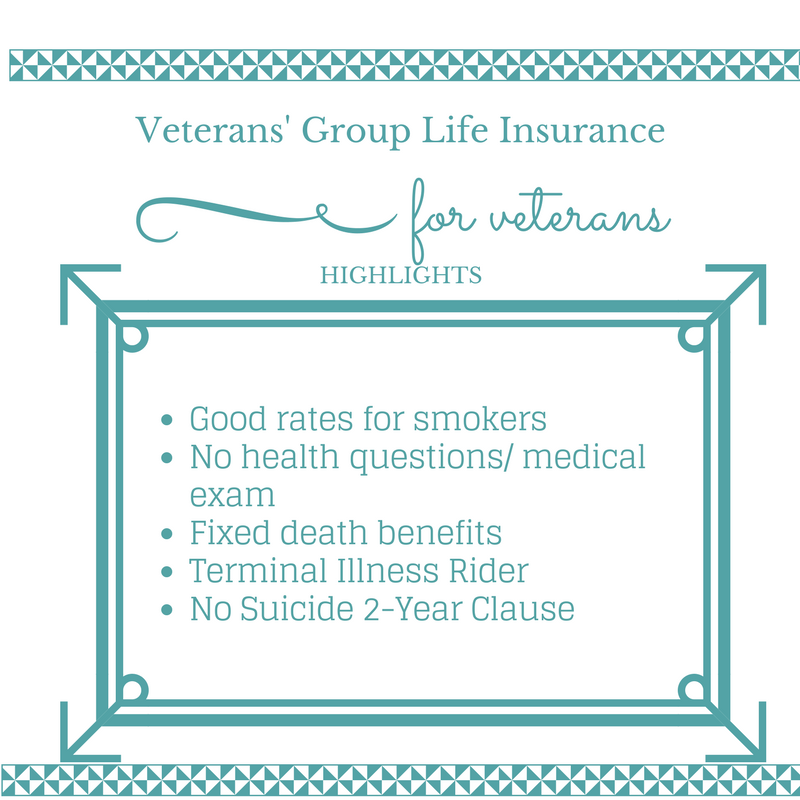

- If you are a smoker then more than likely you will be charged with tobacco rates in any other policy but not VGLI. They provide one of best rates for smokers.

- There are no health questions or medical exam if you convert in the first year and one hundred and twenty days because regardless of how healthy or not healthy you are VGLI charges the same to everyone. If you are applying to VGLI within 240 days of your date of separation you too will not have to answer any health questions or have a medical exam.

- VGLI does not exclude Veterans for reasons related to mental health or Veterans for reasons related to PTSD or TBI.

- As long as premiums are being paid you are covered for your entire life.

- You will not be excluded if you have a job or take part in recreational activities.

- You can choose to pay your premiums monthly, quarterly, semiannually or annually. You can also have premiums come out of your military retirement pay.

- Your face amount or death benefits will stay the same as long as you pay your premiums but you don’t have the option to lower your face amount.

- A lot of insurance companies have a two-year suicide clause or exclusion which means if the insured commits suicide within the clause then their beneficiaries will not be eligible to receive death benefits. VGLI has NO suicide exclusion so in a case of suicide, your beneficiaries will receive your death benefits.

- The last advantage the VGLI offers is the Terminal Illness Rider which means that if the insured is diagnosed with a terminal illness or have a life expectancy of nine months or less VGLI policy will pay out 50% of your death benefits for medical bills or housing fees such as nursing homes or adult day care.

VGLI Cons

- A big downfall about getting VGLI or converting your coverage to a VGLI policy is that when you retire or turn 75 years old your premiums are very likely to double.

- Premiums for younger veterans are fantastic but as a veteran gets older VGLI’s premiums gets more and more expensive.

- You cannot build any cash value on this type of insurance.

Can I convert my VGLI/SGLI/FSGLI coverage to an individual policy?

First of all, what is a conversion? Conversion allows you to transfer your existing group coverage to an individual policy without having to provide proof of good health. If you want to convert your VGLI coverage to an individual policy the answer is yes, you can convert at any time. The answer is yes again, you can convert your SGLI however, you just have to make sure that you have one hundred and twenty days from your date of separation to be able to convert your coverage. If you have an FSGLI policy, or Family Servicemembers’ Group Life Insurance, then the answer once again is yes, but only you and your spouse can convert. Your children may not convert from an FSGLI.

What company can I receive VGLI coverage from?

There are only seventeen companies that you can receive VGLI coverage from. Such as Bankers Life, New York Life, and Prudential Life. Since you only have seventeen companies to choose from your options are pretty limited. Here at InsureChance, we can widen those options for you because we have over 60 top rated companies. If you are considering to get VGLI coverage or convert your SGLI to VGLI, let us help you find the best company with way better rates and make your life a little more simple.

What to consider when looking for the best insurance company

Something to consider when looking for the life insurance company is the ratings of the insurance company you are contemplating about. It is very important for a company to have a fantastic rating such as AA+, A+, or even an A- because these ratings show how stable the company is with their financials and it also reassures the consumers that their money isn’t going to complete waste. For example, if you go with company W and they have the best policy for you and your family, but have only been around for 5-10 years and have a pretty bad rating. Chances are much higher that the money you paid in premiums for your death benefit to be fully paid out to your beneficiary will be thrown in the toilet because if they have a bad rating from A.M Better that just proves that they are not financially stable.

Let’s say that you choose Company W because their application is quick and they offer VGLI which is the only reason you took a second look at the company. They haven’t been around for too long but their rates are within your budget and really just don’t want to deal with other companies because your patience has grown thin after all you’re a Veteran and are tired of dealing with stress. Company W has a poor rating but again, that didn’t stop you from getting coverage from them. A couple years pass and you are now 70 years old and the market crashed slightly but still managed to shake a couple businesses.

The top-rated companies stood their ground because they had planned for any disasters to occur now they get to handle it like true champions. Not Company W, they got a poor rating so that means that their financial stability is weak, so they decided to pull out. What happened to all the premiums you have paid? It’s being washed down the toilet with all the good faith you had for this company. Now you are 70 years old trying to get covered for VGLI, it’s a good thing they don’t give smoker rates because now you caught the smoking habit now that stress came as a surprise.

Why are you stressed? You are stressed now because not only have you wasted all this money and time on a company that couldn’t stand on their own two feet, but that leaves you to get beat up with super expensive premiums now that you’re 70 years old. Don’t let that be you! Shop around, compare quotes, and make the decision of being smart and read the company’s rating. Or simply go to an independent life insurance broker like us!

Work With Us!

In conclusion, VGLI may be a good idea if you have a medical condition, are a smoker, have bad health. If you have amazing health and are not a smoker you may have a better life insurance product with better rates than VGLI available. If VGLI isn’t the right company for you don’t worry because there are many different routes we can take to get you some coverage!Regardless, shopping around is very important when buying life insurance whether you’re 20 or 70. There are always options out there for everyone of all sorts of lifestyles and health. But the truth is, it can be very time consuming just looking through reviews and ratings of different type of insurance companies. You can cut your time in half just by speaking to an independent licensed agent, and the good news is that InsureChance is an independent life insurance brokerage and are here to widen your choices and clear the path for you to receive the best coverage! We work with over 60 top rated companies and many specialize in plans with seniors, let us help you save money because time is money! If you have any questions, or any concerns please feel free to give us a call so that we can make things happen for you: 888-492-1967. Welcome to InsureChance!