You started your search for life insurance and realized that there are many options and companies to choose from. And then all of the sudden either your search or a recommendation from someone you know landed you on a company called Western and Southern Life. You have never heard of them and are wondering if you should apply with them or keep looking. What I can tell you is that I never heard of them either so you’re not alone and we will go through this review process together. Now, this doesn’t mean I don’t know how to pick a winner, far from it. Here at InsureChance, I have reviewed 100’s of companies over the years and we only work with the top rated insurers in the country. In order to find out how this company is we will review their history, financials, ratings, customer reviews, products and of course how they stack up against other large companies.

You started your search for life insurance and realized that there are many options and companies to choose from. And then all of the sudden either your search or a recommendation from someone you know landed you on a company called Western and Southern Life. You have never heard of them and are wondering if you should apply with them or keep looking. What I can tell you is that I never heard of them either so you’re not alone and we will go through this review process together. Now, this doesn’t mean I don’t know how to pick a winner, far from it. Here at InsureChance, I have reviewed 100’s of companies over the years and we only work with the top rated insurers in the country. In order to find out how this company is we will review their history, financials, ratings, customer reviews, products and of course how they stack up against other large companies.

Quick Note: This is a fantastic company but if you’re looking for no exam life insurance that you can buy over the internet or phone they will not work for you. Also, if you’re looking for the best deal you can do much better by comparing rates with all life insurers.

About Western & Southern

As I mentioned before I never heard of this company and I’m in the life insurance business. It turns out though that they have been around since 1888. Wow, that’s an old company and I’m actually shocked I’m just learning about them now. When a company is this old is usually a very good sign for two reasons, first, they are not out to take your money and close down shop. Other reason it shows you that they were able to survive some major historical events throughout history and still be here today. This company is actually a subsidiary of Western Southern Financial Group which is one of the fortune 500 companies in the U.S. They are based out of Cincinnati with total assets of $42 billion dollars.

A company’s financial strength is quite important and that’s why we mentioned their assets. Best way to know how a company does financially is to simply check their A.M. Best rating because this type of agency is designed to go through companies financials every year and issue them a grade. Based on A.M. Best this company was issued an “A+” rating which stands for Superior. Personally, I don’t recommend companies that don’t have an A or higher rating for our readers.

I also did the liberty of checking the word on the web about this company and checked out their BBB page. There are some complaints but very few and they are not the types of ones that I’d usually be alarmed about. What I mean by this is that the company is not denying legitimate claims or simply taking people money without providing a service. According to the Better Business Bureau, the company has an “A+” rating with them. Their website can be better from design and simplicity aspect but they do have a login where you can manage the products that you have purchased with them previously.

The company works through a network of over 1300 field agents that provide sales and service. The company believes this creates a more personalized service to their clients and I can agree however the modern consumer is shifting to a quicker model. In other words, the fact that they don’t have an ability to provide a life insurance policy online or over the phone is a setback. Personally, I got my policy approved with no exam and online within 10 minutes because I’m a busy person.

All in all, they are a solid company with the strong rating, history, service, and financials but they do fall short in their direct sales model so if you’re looking to get life insurance from your tablet, phone or computer find a different company.

Western & Southern Life Insurance Products

This company does offer a broad range of life insurance products to meet your needs. They have term life, whole life, universal life and accidental death life insurance options. Let’s take a moment and break down each product:

Term Life

This is the most popular and affordable option out of all different types of life insurance. A term policy allows you to get a lot of life insurance in exchange for a small monthly sum. They offer two types of term life for this. One is a Simple Choice Annual Renewable and Convertible Term which covers you for one year then the rate goes up if you renew for another year. This plan can also be converted to a permanent life insurance plan without any questions. It is a good option if you need life insurance for less than a few years otherwise don’t waste your money.

The second type of the term is the one we usually recommend and is called Simple Choice Guaranteed Level Term. This is a life insurance plan you can lock in from 10, 15, 20 or 30 year period with a fixed rate and death benefit. If anything happens to you during that time frame your family gets a lump sum payment free and clear. You can also convert the plan to one of their permanent options due to the conversion privilege.

If you want to get a term life insurance policy for your child they have a Term to 25 product which allows your kid to have life insurance until age 25. This is something unique since most companies don’t offer a stand-alone term life on children.

Whole Life

A type of permanent life insurance policies which was actually the first one out. It provides a lifetime protection for people who want guaranteed death benefit and monthly premiums along with some cash value growth. There are 3 options when it comes to whole life with Western & Southern Life which are Simple Choice, Superior Value Life, and Legacy Master. Simple Choice is a whole life plan that offers lifetime protection, cash value growth, and guaranteed premiums. This plan has an option to be paid up full in 20 years, until age 65 or age 100.

The second plan is Superior Value Life which is similar to the Simple Choice but has less focus on cash value accumulation. Because of that it is more affordable and is great for the budget conscious consumer. You can pay it up in 20 years or just have monthly payment until age 100. Last plan is the Legacy Master which is simply a single premium whole life policy. This means that with one payment the policy is paid up and you will be covered for the rest of your life. This is the best bargain if you can afford because you get huge discounts and on top of that you get compounding effect immediately in your cash value.

Universal Life

Similar to a whole life plan but it came after as an improved version because whole life didn’t offer much flexibility. Once you had a whole life plan you were stuck with the death benefit and the rates you initially selected. With universal life, you have lifetime protection and cash value growth but with a lot more flexibility. When it comes to universal life there are different types and sometimes the more flexibility a universal life plan offers the more risk you have with your cash value returns. For this reason, Western and Southern Life created Ultra and Protection Universal Life Policies. Ultra is designed to offer flexibility with higher potential for both up and downside on your cash value growth. For those who are looking for a guaranteed lifetime protection where the premiums and death benefit stay the same, you can go with the Protection Universal Life plan. By the way, a Guaranteed Universal Life policy is one of our favorites, you can read more about it here.

Accidental Death

This is simply a policy that will only cover if you die in an accident. We only recommend these plans if you can’t qualify for a regular life insurance policy since they don’t have any underwriting. This is a good plan to supplement an all-purpose life insurance policy. You can get a Family Accident Plan with the company that will pay out if any member dies in the event of an accident.

Overall, the plans are really solid with positive benefits but they don’t have any no medical exam life insurance options so that’s a bummer for people who hate needles or just want a quicker process.

Western & Southern Rate versus Other Carriers

If possible to get quotes on the companies website we always love to compare how the companies rate is compared to another large insurer we represent. So let’s run a quote on a 40-Year-Old Healthy Non-Smoker Male looking to secure a 20 Year Term Policy for $750,000:

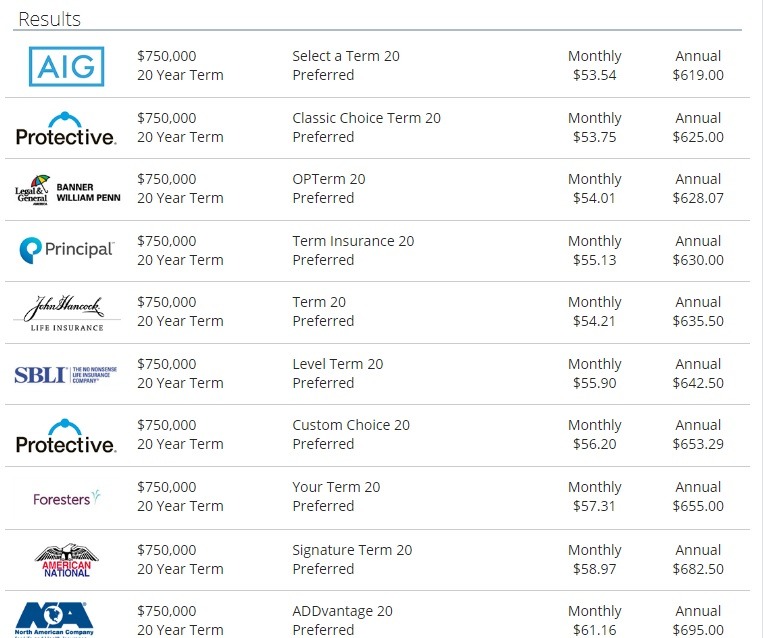

Western & Southern Rate is $90.55/mo versus what came up on our quote engine for top 10 companies:

As you can tell their rates are not competitive at all and you can do much better with a large pool of companies.

In a Nutshell

Based on everything we have learned today this is a great company and you’re definitely have nothing to worry about if you have a policy with them. The company has demonstrated strong financials, reputable history, happy clients and awesome products. However, they do have two huge downfalls which would be the reason I would suggest you go elsewhere for life insurance. First, it that they don’t offer the ability to buy any no exam life insurance policy online or over the phone and its a big mistake in today’s digital world. The other reason is that their pricing is very high when compared to the life insurance companies that we represent and there is no competitive advantage they can offer over those companies. If you’re on the fence, don’t be simply shop around to get the best rate. Luckily for you, you can compare rates right here on our site with a vast number of life insurers for different types of products. Welcome to InsureChance!