When you think convenience, life insurance is probably the furthest thing from your mind. Normally you have to find a plan, figure out how much coverage you need, apply, take a medical exam, wait 8 weeks to see if you qualify and wonder what rate you will get. It can be a pain but not all life insurance companies and products are created equally. As an independent agency we have access to all of the life insurance companies out there and very few products have been as popular as the Family Protection Plan with 5 Star Life Insurance company.

In Summary,

- 5 Star has a term till age 100 product.

- There is no medical exam required.

- Few heath questions and instant approval.

- The coverage is capped at $150,000.

Those are some of the biggest highlights of 5 Star Life Insurance term life insurance product. Now let’s dive into detail.

Term Life Insurance to Age 100

5 star offers a term life insurance product to age 100 called The Family Protection Plan. This is a rare term life insurance product that’s less like a term life and more like a permanent product due to its late expiration. Most term life insurance policies run for 10 to 20 years, this one runs till age 100 with a locked in rate the entire time. As long as you pay your premiums, your coverage remains in force.

This term life insurance policy is a no exam policy. This means you will not have to go through a medical exam in order to get approved. In fact, it even has a simplified underwriting process. All you have to do is answer questions on a 2-page application to determine your eligibility. If you qualify, you’re immediately approved.

At this point the cynic in you is saying “this is too good to be true.” Well the only “catch” is that the coverage amount is capped at $150,000. So if you need more coverage you would have to opt for another no exam policy.

Add On’s

There is a children and grandchildren plan that allows you to add newborns or kids to age 23 for a $10,000 or $20,000 policies.

It also comes with a terminal illness rider that will advance you up to 30% of your coverage amount if you are diagnosed as having less than 12 months to live.

Application Process

The application process is unlike the traditional life insurance process. Normally you would go through an application, followed by a medical exam and underwriting. During the medical exam a nurse would come out to your home, take your height/weight, blood/urine sample and blood pressure. Once completed all of this formation is submitted to the life insurance company to be reviewed. This policy is is nothing like that

The 5 Star application process

The 5 start process is far simpler than the traditional policies. It consists of 2 pages, one which asks you some personal information, and the other a couple of health questions that if you can answer no to, will qualify you for coverage. You can do the application over the phone with an agent at which point you will have to do a voice signature to confirm you’re the one applying for coverage.

To complete the application, you will have to provide payment information. However, your account will not be drafted right away, but instead, two weeks after. That means you get two weeks of coverage for free.

How Do I Qualify for Coverage?

To qualify for coverage, you would simply have to answer “NO” to some of these health questions. If you can answer all of them “NO” then you are approved.

The questions on the application look like this:

Please answer the following Statement of Health for all coverage:

I. Has any Applicant tested positive for exposure to the HIV infection or been

diagnosed as having ARC or AIDS caused by the HIV infection or other sickness

or condition derived from such infection?

Complete ONLY if applying for Simplified Issue amounts:

II. Has any Applicant ever applied for and been rejected for life insurance?

III. Has any Applicant been hospitalized in the past 90 days?

IV. In the past 5 years, has any Applicant been hospitalized for, been diagnosed or treated

by a licensed member of the medical profession or taken prescription medication for:

A. Angina, heart attack, stroke, heart bypass surgery, angioplasty, coronary

artery stenting, or coronary artery disease?

B. Any form of cancer to include leukemia or Hodgkin’s Disease

(excluding non-invasive, non-melanoma skin cancer)?

C. Chronic obstructive pulmonary disease (COPD), emphysema, or any other

chronic respiratory disorder, excluding asthma?

D. Alcoholism or drug or alcohol abuse, cirrhosis, hepatitis, or any other

disease of the liver?

Make sure to answer all of these questions honestly because they can be verified and if found to be fraudulent during the two-year contestable period, then the company will have the right to not pay out.

Who It’s Good For

5 Star life insurance family protection plan isn’t built for everyone. If you’re seeking higher coverage amounts and are in prefect health this may not be the best option for you. However, there are those that can benefit greatly from this policy.

Smokers

Why is this good coverage for smokers? Because there is no smoking question on the application. That means whether you smoke or not you qualify for the same rate in your age group as non-smoker.

Overweight

If you’re overweight according to the build charts, then you’re in luck. The 5 Star application process doesn’t use build charts to determine your rate like most life insurance companies do. It doesn’t matter if you’re over, or underweight, you qualify your rate based on age.

Final Expense

This product all though a “term” by name is very competitive with most final expense products out there. It offers a higher coverage cap and coverage to age 100 at very reasonable rates with a very easy application and approval process. Its perfect for those looking for coverage to cover their final expenses but not healthy enough for traditional coverage.

No Exam for the Not So Healthy

Most no medical exam companies require you to be in good health to qualify and they will check your medical records to make sure you are. This plan is perfect for those who aren’t in bad enough health for guaranteed issue policies, but aren’t in good enough health for simplified issue policies.

5 Star Life Insurance Quotes

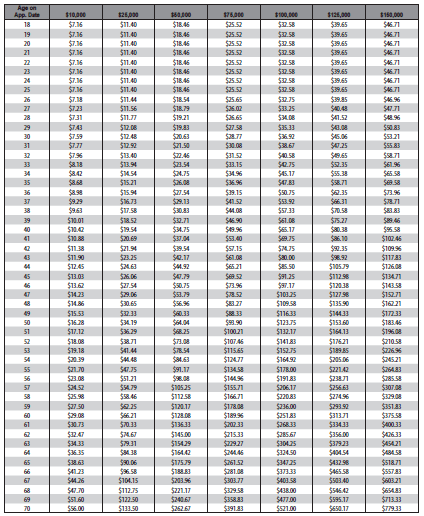

This is usually the first question everyone asks so forgive me that it took so long to get here. I can go on and on about its rates, and rate classes, and coverage brackets, but instead here is a neat rate sheet you can dissect yourself.

About 5 Star Life Insurance

5 Star life insurance company is a part of the Armed Forces Benefit Association which is a life insurance company that provides coverage to worksite and group markets. 5 Star is rated A- by A.M. Best which is a really good rating. They were founded in 1996 and have insured over 800,000 lives with close to $42 billion of insurance in force. In short, you can feel safe applying with this company.

Where to Apply – Start Here

If you’re interested in applying for 5 Star Life Insurance, then you’re at the right place! We’re one of the few agencies who has access to this exclusive product and would love to help you get coverage today, at no extra cost to you! To see a quote simply use the rate sheet or see how it stacks up against its other term life rivals by using our quote engine on this page. Simply select to run quotes for a “30 year” term and you will be able to compare rates with all the companies out there. If you have any questions, call us at 888-492-1967 or hit the chat button below. Welcome to InsureChance!