As an independent life insurance agency, we are able to review life insurance companies without any bias. We never prefer one company over another because each come with their own strengths. This means that the “best” life insurance company is the one that’s best for that particular customer. So the company we think is best is that company that is best for YOU. That being said, how do we feel about Globe Life Insurance? Not so great. Many customers come to us to do comparison shopping vs their Globe product and most of the time, Globe Life Insurance doesn’t make the cut. Does it make them bad? No. But it doesn’t make them good. Let’s discuss what’s good, bad, and whatever in this Globe Life Insurance company review.

As an independent life insurance agency, we are able to review life insurance companies without any bias. We never prefer one company over another because each come with their own strengths. This means that the “best” life insurance company is the one that’s best for that particular customer. So the company we think is best is that company that is best for YOU. That being said, how do we feel about Globe Life Insurance? Not so great. Many customers come to us to do comparison shopping vs their Globe product and most of the time, Globe Life Insurance doesn’t make the cut. Does it make them bad? No. But it doesn’t make them good. Let’s discuss what’s good, bad, and whatever in this Globe Life Insurance company review.

In Summary, here is what you will learn in this review:

- Globe Life Insurance has a term product that offers up $100,000 in coverage.

- It increases rates every 5 years till age 90 at which point the coverage expires.

- Their Whole Life product maxes out at $50,000.

- There is no medical exam required just a quick online application process.

- Thir products are way overpriced.

- Globe Life is NOT a scam but a real life insurance company.

- There are better alternatives for life insurance.

- We recommend to shop around with all of the companies before you make your decision.

Globe Life Term Insurance

*Buyer Beware: Globe’s Term Life Plan goes up in cost every 5 years quite substantially. If you’re in fair or good health you have no business purchasing this plan so be sure to check out term life offers that stay fixed for the entire term, be it 10,20 or 30 years here.

Globe Life insurance has a term life insurance product that offers coverage up to age 90 for up to a max of $100,000 in coverage. This is a no medical exam life insurance product that you can apply for online. The application is fairly simple with just a few health questions that will be verified through the Medical Information Bureau(MIB). As long as you can answer “NO” to all the questions you should be good to go. Here’s where the catch comes in. This term is not a typical level term product. Your rates are on a “rate schedule.” This is a nice way of saying your rates will consistently increase every 5 years according to your new age. This can skyrocket your rates over time. So don’t be lured into the competitive rates they offer upfront.

There is absolutely no reason for you to buy a term life insurance plan if it is not fixed for the entire duration of the term from Globe Life when you can do so with any other top company. This plan may work for people that have exhausted all their options and due to very poor health pick this as the last resort. Notice, we said poor health which means you have multiple conditions and they are severe. You can get very competitive rates with top rated insurers like Prudential, Banner Life and many more with a term life insurance plan that will stay fixed for the entire term.

If you were thinking about applying with them due to being able to skip the exam, we have good news for you. There are about ten life insurers that will give you an ability to do that with up to $500,000 of life insurance and not $100,000.

Globe Whole Life Insurance

Their whole life insurance is their permanent product which offers a max of up to $50,000 of coverage. So its a policy good for final expenses. Things like funeral costs, legal fees and anything else associated with your death. This is just about all the information regarding this product I can find out there. I usually don’t recommend whole life to a majority of my clients but for those that desire it, I recommend to ALWAYS shop around.

One thing I can recommend to you is to go for a Guaranteed Universal Life Policy if you’re in fair or good health. This is the most affordable permanent life insurance coverage that will save you a ton of money and allow you to get as much life insurance as you’d like. Final expense policy is good for people who don’t qualify for better options.

Globe Life Cost vs Other Carriers Cost

Globe is famous for their advertising of this product which is “$1 buys you “X” amount of life insurance.” And this is only true for the first month of coverage. Not to mention that during the online application you will be asked to pay the premium for the first two months of coverage. So I can’t even call it good marketing. I would know, I’m the Director of Marketing for InsureChance and good marketing revolves around the entire customer experience from start to finish, not just a good ad to get you on the hook.

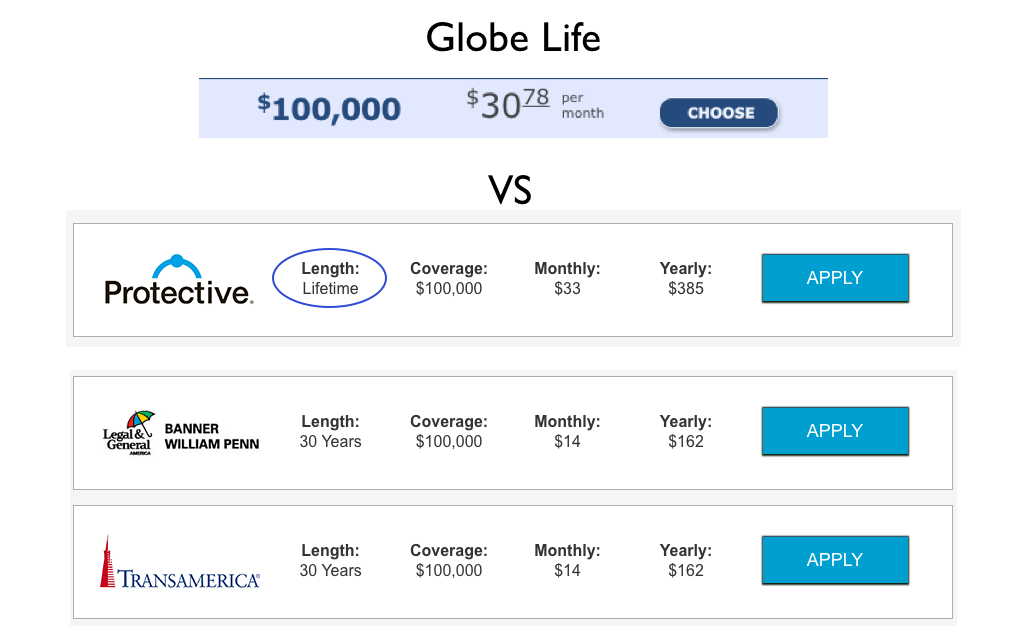

As far as the cost I ran a quote for myself as the healthy non-smoker male that I am and got a rate of $30 for $100,000 of their increasing “rate schedule” term product. I then ran a quote for a lifetime coverage with Sagicor(a no exam carrier) for $100,000 and received a $34 quote for a LIFETIME product. I also ran a quote for a 30-year traditional term product(with exam) and the quote with Banner Life and Transamerica came in at $14 a month. These are level term products that are convertible. Which means you can convert the policy to a permanent one once it expires.

Note: As you can see, their products are overpriced in comparison to other companies. Why would you pay for their term plan that goes up every 5 years when you can secure a lifetime policy that will pay out at one point or another for the same cost. Or you can save half of your money by getting term life with another carrier.

Add On’s

Most companies come with policy add-ons called riders like Accidental Death, Accelerated Death, Convertible Option, Disability riders, etc. With Globe Life, you get an option to add up to $150,000 in accidental coverage to your policy. This means that if your death is the result of an accident your beneficiaries will get $150,000 on top of your death benefit amount. If your death is the result of natural causes, they will just get the original death benefit amount. For me the cost was an extra $15 to add this to my coverage with Globe, I prefer to add that $15 and get a bigger “all-cause” coverage with a competitor.

Globe Life Vs Competitors

Overall most life insurance companies offer seem similar on the outside but the difference is in the details. Their most marketed product is their term life insurance so let’s compare the Globe Life offer to everything that’s out there.

Price – I can say that Globe Life is expensive. Initially, the rate can look decent, the issue it is it will continue to rise every few years, and this will raise your rates dramatically. The edge in price I would give to its competitors purely from a standpoint of long-term thinking and value.

Product – At first glance, it seems impressive that you are covered till age 90. However when you favor in that the coverage isn’t truly level, then the competitors take the edge again. As an alternative, you can get a term life insurance policy that will be level for 20 to 30 years that comes with a convertible option at no extra cost. This means that you will be able to convert your term policy to a permanent product if need be, without having to prove good health. You rate would simply be adjusted to your new age. Most companies like MetLife, Prudential, Protective, and Banner offer this with their term policies at no extra cost.

The coverage is also capped at $100,000 with Globe Life, other companies don’t have limits and if you’re looking for no exam companies you can get coverage for up to $400,000 with companies like Phoenix and Sagicor and up to $250,000 with companies like Fidelity and American National.

Process – this is where I can give Globe some credit. Their process is a simple step by step online application that seems to be it. The only downfall is it lacks details that, if I was the consumer, I would need to know. That’s where a knowledgeable agent can come in handy but if you’re the do it yourself type, not a bad choice. The only question you have to ask yourself is if this is the best coverage for you before you apply. As there are other companies that have online applications. It’s definitely much faster than traditional term life insurance and competitive with the speed of other no exam carriers.

What Everyone Else is Saying

Every time I set out to write a review about life insurance company I do my best to do all the research I can before drawing a conclusion. I never intend to set a negative tone for any company but I just wasn’t happy with what I saw in this case. From the marketing to the product offer, to the consumer complaints. Here is what I found being said across the internet.

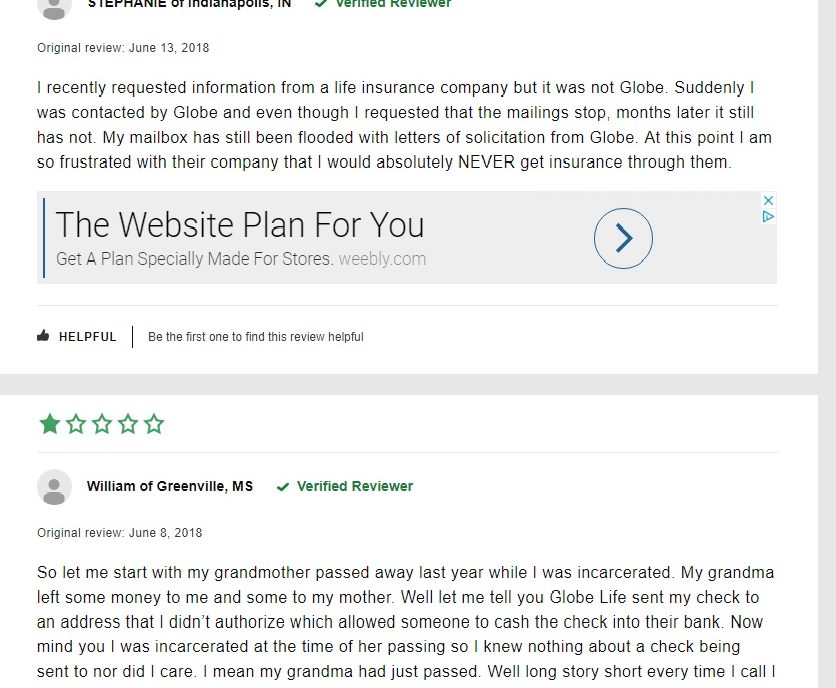

First thing I noticed is that they were listed on ripoffreport.com with a complaint of unpaid policy claims and bad customer service. They were accused of losing important paperwork and being unresponsive to a death claim. Another client in the comments alluded to experiencing the same thing.

Other complaints are about the long hold times and inadequate customer service. The other reviews you will find are independent agents that have an issue with the products and prices. They also recommend to always shop around, as do I. Here is a screenshot of some reviews from ConsumerAffairs in 2018:

A Little About Globe Life Insurance

One thing I would want to clear up for folks out there is Globe Life Insurance is NOT a scam. They are a real life insurance company with a real life insurance product. They have been around since 1951 and have an A.M. Best rating of A+. This is a really good rating given to it by a financial institution for its financial strength.

The big issue with them is their marketing tactics are very deceitful to the general public who doesn’t spend their days dealing with life insurance policies. They can do much better with the type of products they offer to consumers by looking at their size and popularity. And like I mentioned before, this company has a place for individuals that couldn’t get approved by other companies and were able to secure a policy with Globe. Other than that, you’re much better off with other options.

Personally, I never experienced their customer service but it seems like they have a few hundred angry policyholders who state their distaste. Here at InsureChance, we prefer to recommend companies that are customer eccentric and provide high-quality client service. The company can have great pricing, reputation but if they have bad service it can make things absolutely terrible.

In summary, Globe Life is a legit company and they have carved out a niche for people who have a small need for life insurance and may not qualify for other plans. But they have no business in being considered by individuals who can qualify for other types of life insurance.

Shop Around

In the end, I personally would recommend everyone to do their due diligence first and shop around with all of the life insurance companies out there. Now, this may sound tedious, that’s why there are independent agents/brokers/agencies out there that can shop around on your behalf. The good news is you’re at the right place! Welcome to InsureChance! We represent all of the best life insurance companies on the market and do the shopping for you at no extra cost to you! Whether you go direct or apply with us, you will get the same rate. The difference is the knowledge and expertise we provide. If in the end, the conclusion is that Globe Life is a better choice for you, we will recommend it 100% of the time(it just might be unlikely). To compare rates with all the companies simply use our quoter or give us a call at 888-492-1967 if you have any questions.