Factors Life Insurance Companies Consider with ADD/ADHD

When applying for life insurance with Attention Deficit Disorder its important to know that the life insurance company will want to know how long ago you were diagnosed, the severity of your condition, types of medications you take, whether or not it impairs your daily living and your overall health. They will also want to know if you were ever hospitalized for the condition and if there are any other mental health disorders associated with your ADD. As far as your overall health the companies will look at factors like your height/weight, smoker status and family history in addition to the ADD. Once the company has the entire picture they will determine an appropriate risk class for you which also sets the monthly premium that you will pay for your policy.

Some of the questions that the life insurance companies might want to ask:

- When were you diagnosed with ADD/ADHD? -Let’s them know how long you have been managing your condition. Typically, the longer you had it the better it is usually managed.

- How many and types of medications you take for it? – If you take one medication with an average dose, you’ll have a very easy time to get coverage. However, if you’re taking multiple medications or heavy doses it is an indicator that your condition may not be mild.

- Are you on Social Security Disability? – Here the company wants to know if your condition is bad enough that you are unable to work.

- Do you have any other medical conditions? – If you have any other mental health issues or physical health impairments it will work against you.

Risk Classes to Expect

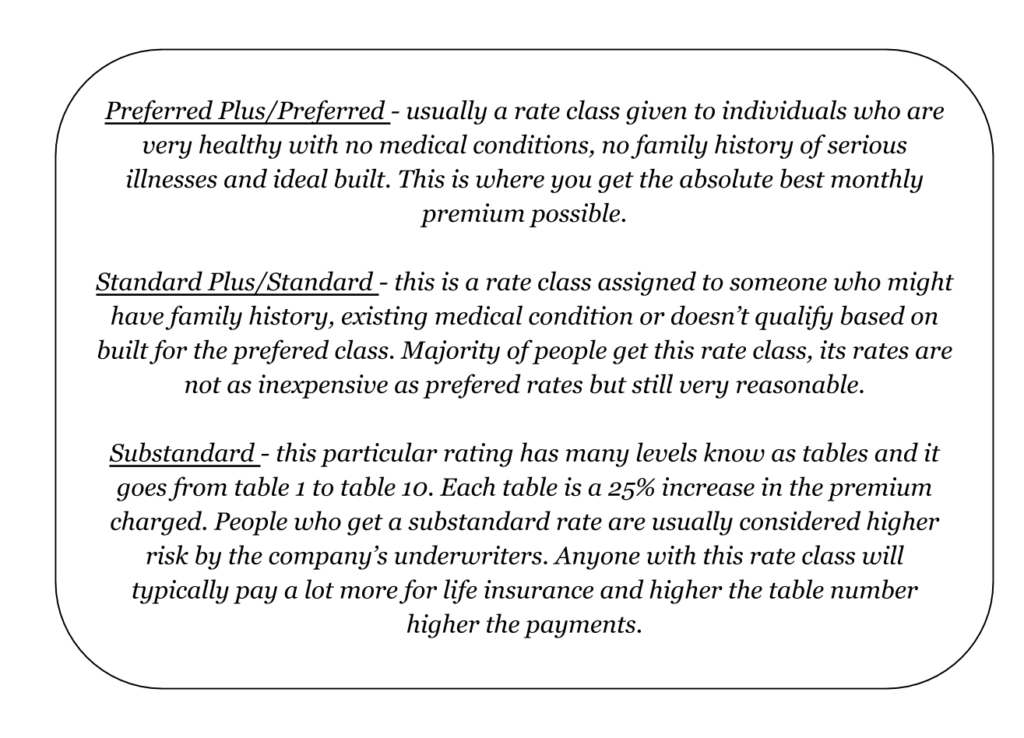

Below is an image that describes all the possible rates classes an applicant can get after the company conducts their review.

Moderate – Taking higher dosage or stronger medications with your condition or having an additional mental health disorder can result in Standard rates. The good part is that even at a standard rate class the rates are still competitive. In some cases, if you have all other positive factors like ideal build, no negative background information, healthy family history and no bad habits, some life insurance companies like Banner Life or Principal Life can bump you up to preferred rate by giving you underwriting credits.

Severe – For anyone that is heavily medicated, on disability due to their condition or has been hospitalized in the past can expect to get substandard rates and in some cases be declined (very rare). Even though we are breaking this down, we have yet to speak with anyone who was in this position due to ADD/ADHD.

Let Us Help!

To get the best outcome there are a few things you can do. First thing is to be upfront about your condition with your agent so they can know which company to apply with. Second be sure to work with an agent or agency that is independent and specializes in high-risk cases. This will ensure that you have all the companies at your disposal and that you are applying for the most competitive rates for ADD. There are some additional things your agent can do such as shopping the case anonymously with various companies to kind of get an idea of where the best deal will be. That is a huge time and money saver!

Also, your agent should provide additional details in the notes part of the application about factors that the underwriters don’t have such as a healthy lifestyle and reasons for coverage. Luckily for you and us, you are at the right place and we would love to do the whole process on your behalf so please do reach out to us. Not only will our agents go the extra step by drafting a cover letter on your behalf to get you a better rate, they have a ton of experience with placing cases with both ADD and ADHD.