Life insurance is one of the most important things you need to protect your family’s financials. When you pass away your debt does not die off it gets passed down to your family members. If you’re looking for a term life insurance cost calculator simply follow the arrow and use our quote engine to your right to calculate the rates for you. Personal information is not required to compare rates with all the companies so feel free to browse in peace. If you want to learn more about how your costs are calculated please read further.

In this article, we will be showing you what the life insurance companies do to get your life insurance cost. There are a couple of things that they do upon your application to see if you qualify to buy coverage from them or not. The following are some key points from this article;

- We will be discussing how life insurance companies create your rating.

- Then we will be discussing the different steps you will have to take in this journey.

- You will understand all that you need to understand when it comes to getting life insurance.

How do life insurance companies create your rating?

Life insurance rates are typically based on:

- Health

- Build

- Background

- Tobacco Use

- Age

- Gender

- Coverage Amount

- Coverage Type

To simplify it, your rates are determined by risk. The higher the risk of payout by the company(your death) and the higher the amount, then the higher the premium that you pay. It’s important to keep in mind each company determines risk slightly differently but let’s briefly dive into how each one is used to calculate your cost.

Health

Your overall health is one of the biggest weighing factors in determining your rate. If you’re in perfect health with no family history you can expect to receive the best health rating. If you have any medical conditions but they’re under control you can still expect a Preferred rating unless you have a family history of illness. Anything other than that will place you in a Standard or Substandard rating.

** Health is one of the few factors in your life insurance cost that can be different from company to company and is not in black and white. So if you have any serious medical conditions we suggest skipping the cost calculator. Because the company with the lowest rate on the quote engine may not be the company with the lowest rate for your specific condition.

Build

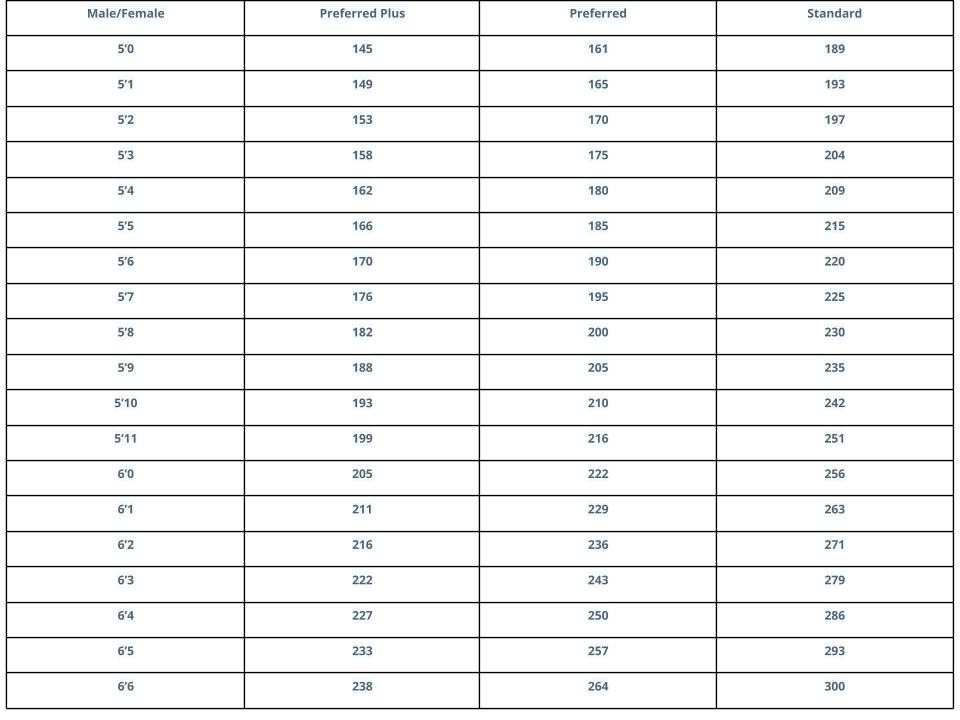

Your build is your height and weight ratio. Not all companies use the same build chart but overall you can expect something similar to the chart below for most carriers.

Background

Outside of health history, the life insurance companies will determine your cost and eligibility based on things like your history of felonies, bankruptcies, and driving history.

Tobacco Use

Smoking cigarettes can raise your rates close to 50% or more depending on your age and health. For other tobacco products like cigars, chew and e-cigarettes, most companies will give you smoker rates, however, there are a few select companies we work with that will give an exception for non-smoker rates for alternative tobacco use.

Age/Gender

This is the most obvious and black and white calculation there is. If you’re older or a male you will typically have higher rates than if you’re younger or a female.

Coverage Amount/Type

The amount of coverage you want will directly influence your cost. The more coverage the higher the premium. When it comes to coverage type, term life will be your most affordable option, usually 2 to 4 times less than a permanent life insurance product like Universal or Whole Life. There are also no exam life insurance options like simplified or guaranteed issue plans which tend to be more expensive due to the higher risk is taken on by the life insurance companies. As with all these factors.

Rate Classes

In the end, your rate is really calculated by determining the type of risk that you are to the life insurance company. This ensures that the company is always financially strong enough to pay out death claims. Based on the factors mentioned above you will be assigned a “rate class.” These rate classes are each assigned their own rate. Here is a quick break down of each.

Preferred Plus(Super Preferred) – this rate class is given to individuals who are in perfect health and great background history. This is the most ideal type of client for the life insurance company so they’re given the best rate.

Preferred – this is much more common rate for healthy individuals with other than perfect history or very minor conditions.

Standard Plus/Standard – these two rate classes are for people who have a family history of health problems or existing medical conditions such as high blood pressure, high cholesterol, depression, etc. As long as it’s not severe the standard plus/standard rates are possible.

Substandard – this is the most costly rating you can receive. The substandard category breaks down into 10 “table” ratings. Each table increases your premium by 25%. The higher the table the higher the rate. This will be for anyone with serious medical conditions or dangerous hobbies and occupations.

Steps to getting life insurance coverage

Now that we know how a life insurance company comes up with your rating you should now know what to do next. You have made one of the best decisions of your life by getting life insurance and the first thing you should do is exhaust all your options until you find the best life insurance company that reflect your specific needs, health, and lifestyle. If we could tell you who the best life insurance company is we would but the truth is, we don’t know who the best life insurance company is since everyone has their different reasons to buying life insurance and everyone’s needs, health, and lifestyles are different.

Shop until your fingers drop

The first thing you need to do to make sure you are getting the best buy possible is literally shop until your fingers can’t take it anymore! you should be comparing quotes with some of the best life insurance companies until you find one that fits your budget. Life insurance shouldn’t break your budget at all, there are already a million of other things you are buying and paying for as far as protection the last thing you need is another bill that will burden your budget. Working with an experienced and independent life insurance agency is one of the best things you can do for yourself. An independent life insurance agency like us can lead you to the right place! We work with over 60 top rated companies and can help you find the best company who offer the most affordable premiums but offer the maximum amount of coverage humanly possible. We will explain a little more about ourselves below!

Work with an experienced independent life insurance brokerage

Working with an experienced independent life insurance brokerage will allow you to exhaust all your options. That is exactly what you need to do to be able to get the best price for coverage. If you have a medical condition you should definitely be working with us because you will get a bad rating for having whatever condition you have unless you have the knowledge you need to get a good rating. This knowledge that we speak of is every life insurance company’s underwriting brochures as well as an understanding of each of the company’s niche. Every life insurance company has a niche of theirs that makes them “specialists” of these specific niches. For example, if you have diabetes you should be applying with Prudential because that’s one of their many niches and they understand everything to do with diabetes. If you apply to a company that specializes in sleep apnea you will be finding yourself getting rated up rather than it helping you it will be more expensive since they don’t understand your medical condition they can’t help. Working with us means that we know exactly which company to go after and which ones to leave behind.

Time to apply

The time we have been waiting for! You have found the best life insurance company for you and they fit your specific needs, health, and lifestyle. AMAZING! It’s time for the application to be filled out, working with us means that we will do all the grimy work! If you give us a call we will fill out the application while you are on the phone and going through it like a slice of cake which will only leave you to get your autograph for security purposes. During this stage, we will be asking you a couple of health questions and also will be asking about your past health, your family history, and any violations driving related. This will help us get an idea of whether or not you will be able to get approved by this company or not and if we believe you will get approved we will move on and continue with our application.

Now for the needles

Now that the application has been submitted we will send you over to our personal assistants who handle the appointments. The best part about getting a medical exam is that you will be able to pick and choose when and where you would like to receive your medical exam. It will take between 20-30 minutes for your exam to be completed. Unless you choose the no exam option but in order to get a cheap term life insurance policy, you will need to undergo that exam. This exam will consist of taking your blood pressure, your height and weight, your blood and urine sample. Once the nurse has completed you are free to fly as a bird. However, we do recommend you to schedule your medical examination to be in the morning so that you don’t have to fast and you can go about your day the way you regularly had it planned. We also recommend no partying the night before and make sure you eat very well the day before and drink two full glasses of water the morning of so that your lab results are as impeccable as you! Also, skip that morning joe unless you want your labs to be out of whack!

Underwriting

The most boring but most effective stage of the whole application process is the underwriting stage. Don’t worry, this part doesn’t involve you at all! This part is specifically for underwriters from the company who’s duty of the day is analyze your life (application) and go through whatever they have to go through to find out more about you. This means MIB (medical records) DMV records and your pharmacy records. In this stage, they will determine if you lied even just a little bit on your application and compare with their results and find out if the rating you are going to be given is fair or not.

The best part of it all- APPROVAL

The best part of this whole process is your approval. This is the most exciting because it means you are done with all of this and you can continue to live your life to the fullest again now knowing that your job is done and if anything happens to you, your family will be protected either way. You will know if you are approved or not when you receive notification from us via email or call either way you will be hearing from us again! Now that the whole process is over you can feel free to send us a family picture and give us an update of how amazing your life is going or only call us to update details, we will love both of course!

Work with us!

Those are the rate classes that you can fall into and will be combined with all of the factors and a company’s current pool of clients to calculate your cost for a life insurance policy. You can read this article to learn how to get the cheapest life insurance policy or let us do all the work for you. You can use our quoter to compare quotes and request an application online or gives us a call today!