You may want to get more coverage than what your employer is offering or you simply can’t have any life insurance through work and are wondering if you can get a personal life insurance policy. The answer is Yes! And you definitely should even if you have a policy through your job. Just like it sounds a personal life insurance policy is yours to keep regardless of where you live or work, so you’ll always have a coverage. So let’s analyze all the details that you need to know about personal aka individual term life insurance policy. Here is a quick summary for my fellow cliff notes fans:

You may want to get more coverage than what your employer is offering or you simply can’t have any life insurance through work and are wondering if you can get a personal life insurance policy. The answer is Yes! And you definitely should even if you have a policy through your job. Just like it sounds a personal life insurance policy is yours to keep regardless of where you live or work, so you’ll always have a coverage. So let’s analyze all the details that you need to know about personal aka individual term life insurance policy. Here is a quick summary for my fellow cliff notes fans:

- Personal life insurance is an individual policy that you pay for and get to keep no matter where you go.

- There are two types of individual life insurance, term, and permanent life insurance.

- Term life insurance and Permanent life insurance have been debated since their existence by financial experts and rookies alike, with both teams cheering for both products.

- Term life insurance is a plan with a focus on pure protection, offering coverage from 10 to 30 years with a focus on affordability. Permanent life insurance is a lifetime plan which may be a whole or universal life.

- Universal life is a form of permanent life insurance in which provides coverage for your entire life. Universal life has a cash value just like a whole life policy but the difference is that a universal life product comes with the flexibility that a traditional whole life insurance policy doesn’t provide.

- The difference between universal life and variable universal life is that its variable is a form of cash-value life insurance and offers both a death benefit and an investment feature.

- Indexed Universal Life is a type of permanent life insurance plans that have cash value accumulation based on market indexes.

Personal life insurance versus Employer Plan

Most individuals get introduced to life insurance during open enrollment at their jobs and that’s how they end up getting a policy. The employer sponsored life insurance has a few benefits since you’re getting a plan within a pool of many applicants so there are not many qualifications to get approved. It is also good since usually, an employer will pay part of the plan on your behalf to make the premiums affordable. The downside is that if you’re healthy you’re paying higher premiums for all the individuals in the group with fair or bad health. Also, if you ever get terminated or quit you may lose your life insurance coverage and this can become bad since you may be older or not in great health anymore to buy an individual policy.

Personal life insurance is owned by you so no matter where you go you can take the policy with you and not have to go without life insurance. In some cases, an individual policy can cost the same or more than a group plan due to the employer contribution. However, if you take our advice and shop around with all the top carriers you may even find a policy that is more affordable! The downside of a personal life insurance policy is that you do have to qualify for it medically and in the event that your health is not great an employer sponsored life insurance maybe a much better option for you. Your beneficiaries receive this lump sum because of the premiums you have paid (periodic payments). Once you have decided to buy a life insurance policy, you need to ask what the different types of life insurance are. That’s a fair question to ask yourself because before you buy a life insurance policy you should be well versed in the different types of life insurance just so you can make sure which one would be the best for your specific needs, health, and lifestyle.

When securing a life insuance plan you have an agreement with the company that in exchange for your premiums the carrier will provide a lump sum to you loved ones. Your beneficiaries receive this lump sum because of the premiums you have paid (periodic payments). Once you have decided to buy a life insurance policy, you need to ask what the different types of life insurance are. That’s a fair question to ask yourself because before you buy a life insurance policy you should be well versed in the different types of life insurance just so you can make sure which one would be the best for your specific needs, health, and lifestyle.

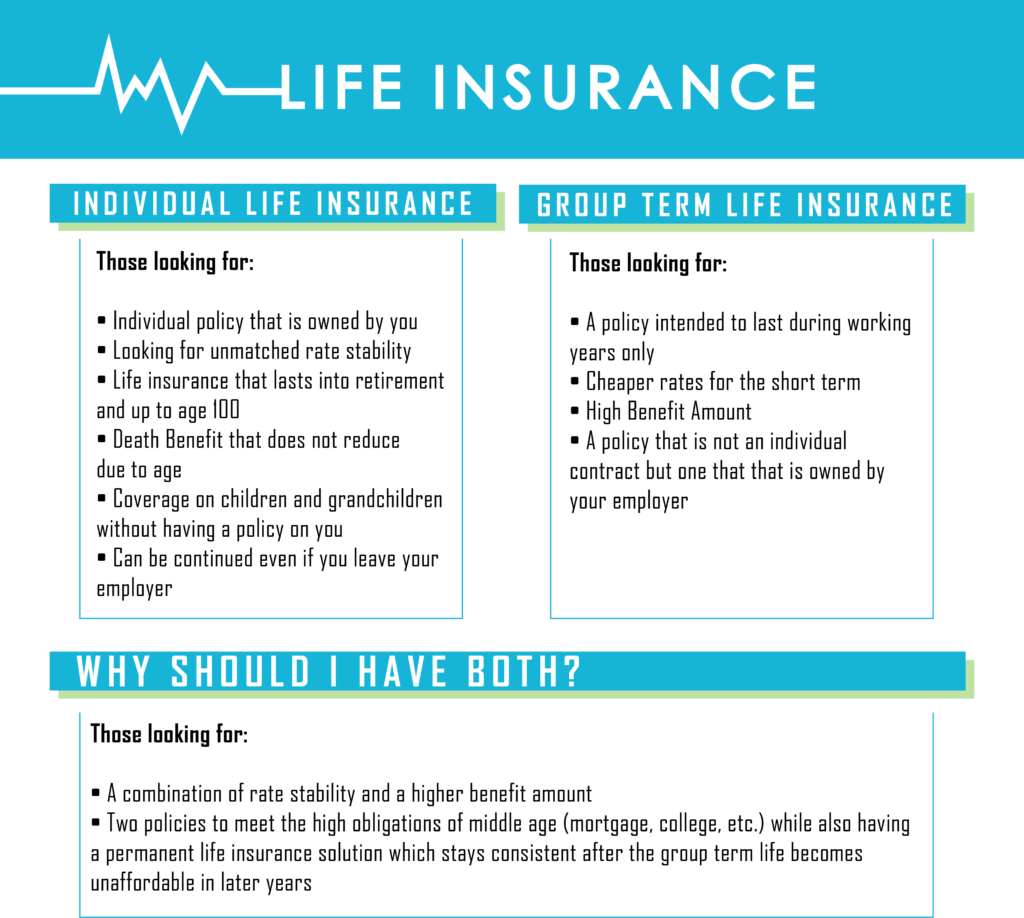

Here is a great excerpt with a comparison chart from fbsbenefits.com:

SIDE BY SIDE

“Life insurance can be a very flexible and powerful financial vehicle that can meet multiple objectives, from providing financial security to building assets and leaving a legacy. Deciding whether to purchase individual life or group term life insurance is a personal decision that should be based on the financial needs of your beneficiaries as well as your financial goals. Consider the following chart to determine which one is right for you.”

The different types of life insurance Policies

There are two types of life insurance, term, and permanent life insurance. A term life policy is a form or temporary life insurance in which provides coverage for a short and specified period of time. Permanent life insurance obviously is self-explanatory, it is life insurance that is permanent and provides coverage throughout your entire life. However, with permanent life insurance, there are different types like whole and universal life.

Term life vs Permanent Plans

Term life insurance and Permanent life insurance is quite a hot topic amongst many insurance and financial services professionals. Some say buy term invest the rest, others scream to get a lifetime coverage with a chance to get rich with cash value accumulation. And till this day the debate continues but here at InsureChance we say get life insurance and the type you should get will be based on your needs. Both types of plans have their purpose for different situations. If you are in your 30’s and starting a family with a new mortgage then a term life insurance policy would be your best choice. The reason is that you can get a large amount of life insurance for an affordable premium and the plan will cover you until the kids are out of the house, the house is paid off or you are retired. With a term plan, you can get the length of the coverage from 5 years all the way to 30 years.

A permanent life insurance plan will not have a quote on quote expiration date and will cover your until the ripe age of 100 sometimes even longer. There is another big appeal with permanent plans which is the accumulation of cash value that can be later taken out for emergencies or purchases. So it is actually part life insurance part investment vehicle and 100% family protection. This type of coverage is ideal for people that are at later stages of life or simply want to leave money behind regardless of when they pass. From our experience, people over age 50 are the biggest buyers of these type of life insurance plans.

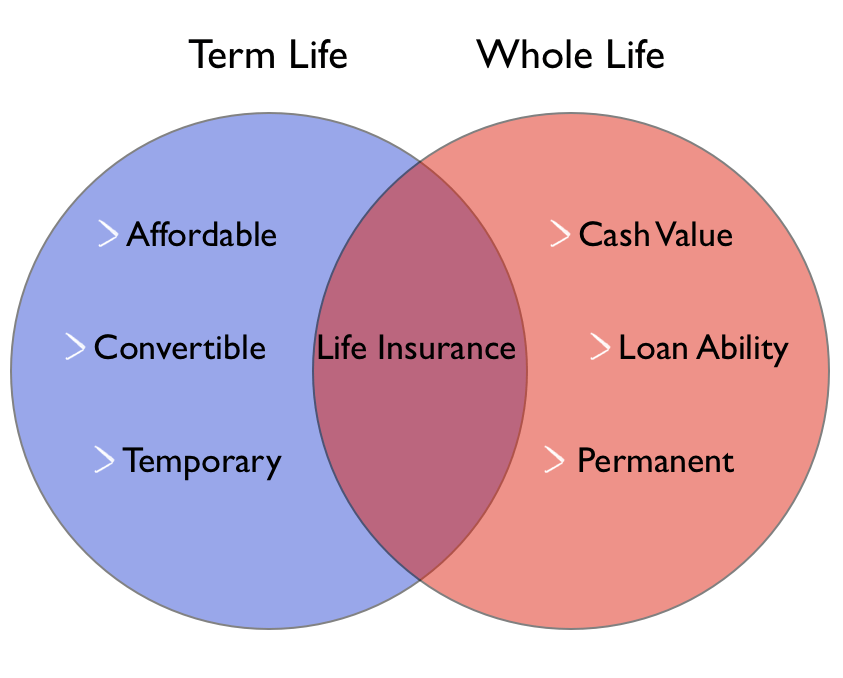

Here is a cool little image showing some differences between term life and whole life which is a type of permanent life insurance:

*For a full breakdown of all life insurance plans click here.

What is permanent life insurance?

As we mentioned earlier, there are two types of life insurance, term and permanent. Permanent life insurance covers several different and specific life insurance types. It is a given that permanent life insurance provides you with coverage permanently as long as you pay your premiums. Permanent life insurance also has a cash value component. Permanent life insurance consists of a couple different types such as whole life (which we explained earlier), universal life, and variable life.

What is universal life insurance?

Universal life is a form of permanent life insurance in which provides coverage for your entire life. Universal life has a cash value just like a whole life policy but the difference is that a universal life product comes with flexibility that a traditional whole life insurance policy doesn’t provide. By flexibility we mean you literally have flexibility in the policy. If you decide you want to change your premium payments because your life changed a little bit or you want to change your death benefit amount, you can with universal life insurance. Universal life is meant to help you fit your life insurance policy with your ever so changing life. You can also pay your premiums with your cash value this means that if you have enough money in your cash value, you can use that to skip premium payments entirely. Another thing about Universal life’s cash value is that it has an interest rate that’s sensitive to current market interest rates. This flexibility makes universal life insurance appealing to some people but it can also be confusing to others.

How much life insurance do I need?

Typically, you want to go with a rule of thumb of 10 to 15 times your income. For a more specific approach use a needs analysis calculator to figure this out.

Personal Life insurance quotes

| Age: | Coverage: $250,000 | Coverage: $500,000 | Coverage: $750,000 | Coverage: $1,000,000 |

|---|---|---|---|---|

| 20 | $15.23 | $24.36 | $33.49 | $42.63 |

| 25 | $17.18 | $28.28 | $39.57 | $50.46 |

| 30 | $19.91 | $33.25 | $47.87 | $58.62 |

| 35 | $22.31 | $33.25 | $55.07 | $66.50 |

| 40 | $30.19 | $53.81 | $79.63 | $95.38 |

| 45 | $45.94 | $85.31 | $125.54 | $162.75 |

| 50 | $72.41 | $134.35 | $198.94 | $259.00 |

| 55 | $128.84 | $251.56 | $374.28 | $431.38 |

| 60 | $693.000 | N/A | N/A | N/A |

What if I have a medical condition?

If you have a medical condition the quotes above will not be what you will be looking at. Depending on how serious your medical condition is you should prepare yourself for higher premiums than those who don’t have a medical condition. If you have a serious medical condition then you should work with an independent life insurance agency (like us) because they will know which company specializes what and which one fits best for you. For example, if you have high blood pressure you want to make sure that you are working with a life insurance company who specializes in high blood pressure and not with one who specializes in sleep apnea. The companies who specialize in high blood pressure understand that medical condition better than any other company and will not rate you super high (like others would). We are an independent life insurance agency who is well aware of all the unique niches that come alongside with each life insurance company.

Work with us!

If you are looking for personal life insurance work with us! We offer a FREE service of comparing quotes with other top rated companies. We work with over 60 top rated companies who all specialize in different categories. Not only do we shop around for quotes and don’t quit until we find the best life insurance company for you but we also fill out the whole application for you so that you can spend more time with the ones who matter the most, your family. Give us a call today and let us find the best life insurance company who reflect your specific needs, health, and lifestyle.