Getting life insurance with a bipolar disorder might seem like a daunting task. It might be if the right steps are not taken to ensure the best possible outcome. To do that you must work with an experienced agency that can pick the right company, be able to show evidence of compliance and take extra steps to get the likely outcome. Based on the severity of your bipolarism you can either get the best rates on the market or get declined. All based on control of your condition and picking the right carrier that welcomes the risk.

What Life Insurance Companies Look For

Not all companies will want to approve coverage to someone who has bipolar disorder but there are others that welcome the risk. Here are questions that these companies will ask when reviewing your application.

- Severity – you will be classified as either having mild, moderate or severe case of bipolar disorder.

- Date Diagnosed – if you have been recently diagnosed than it is more likely to get postponed. Postponed application simply means that they are putting you on hold until they see some time pass showing that your treatment is working and that you are compliant.

- Type of treatment – the company will want to see what kind of medications you are taking, are you getting regular consultations with your mental health practitioner and are there any other things you are doing. Things like participation in support groups, diets or exercising.

- Effectiveness of treatment – usually the companies like to see that your treatment has been shown to control your disorder for a period of one year or more.

- Types and doses of medications – this will affect your eligibility as well since taking certain medications with varying doses can show how bad or stable your condition is.

- Hospitalization – most companies will approve individuals who have not been hospitalized within the last 2-3 years. If you have been hospitalized there is a high chance of getting declined.

- Suicide attempts – similar to hospitalization carriers want to see that a suicide attempt has not occurred within last 2 or more years.

- Are you currently working or disabled due to condition – people who are actively working and socializing are the optimal risk for companies. If you are disabled due to bipolarism you can still get coverage but at higher rates since it shows the condition has a strong affect on your life.

- History of drug or alcohol abuse – someone with substance abuse on top of bipolarism is a very high risk and it is not a good combo when applying for life insurance.

Bipolar Disorder and Life Insurance

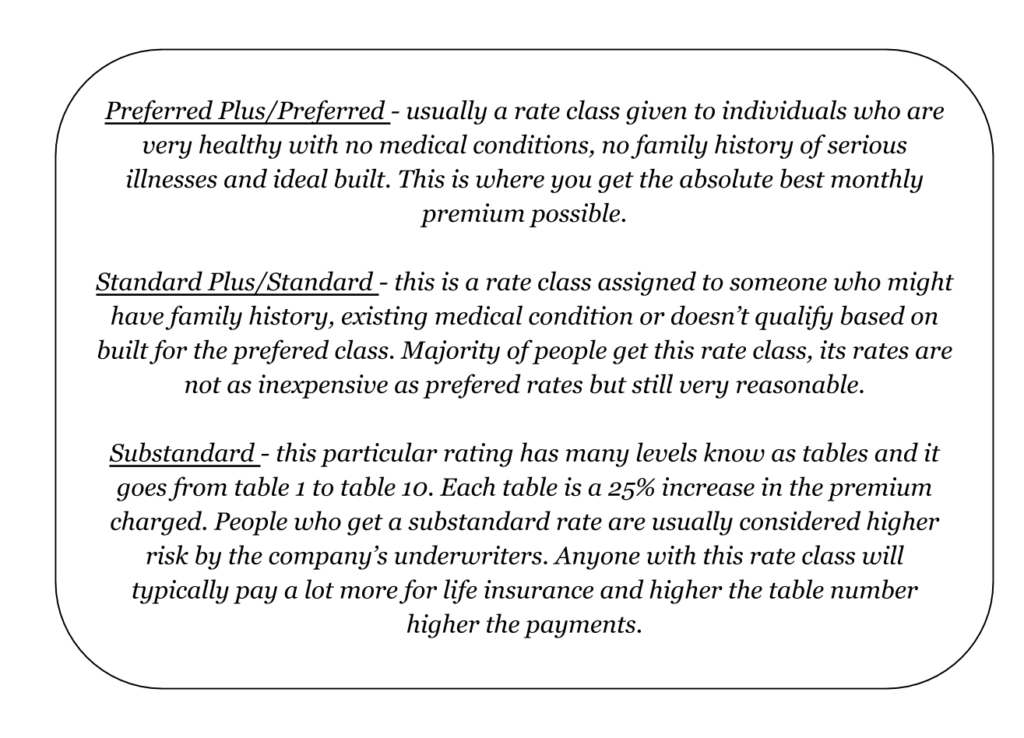

Life Insurance carriers will review all the information gathered and will assign a rate class based on your overall risk. Here are some possible outcomes based on severity of your condition.

* Please refer to image below for rate class explanation.

Mild Bipolar – you are currently working, have an active social life, strong support network, no attempted suicides or hospitalizations. Your condition is under control with single low dose antidepressants. Expect a standard rate class to substandard table 4. If you have strong recovery with no medication needed preferred rates are possible.

Moderate Bipolar – if you had one or more episodes, no more than 30 days of lost work time, no suicide attempts or hospitalizations within past 2 years, satisfactory response to treatment, and good support network. For this category you can expect to get a substandard rate class ranging from table 4 to table 6. Better rates are possible if you are closer to mild category.

Severe Bipolar – continuous episodes, more than 30 days of lost work or total disability, multiple hospitalizations, suicide attempts in the past 2 years, high strength medications and no support network. With severe bipolar disorder you can get approved at substandard table 8 or most likely get declined.

If you get declined don’t worry since you can restart the application process once you have a better record of control and compliance. Also you can apply for a graded death benefit policy. This type of policy usually offers a smaller face amount that will fully kick in after 2 or 3 year waiting period. The good part is that you can qualify very easily.

Tips to Increase Life Insurance Approval with Bipolar Disorder

Majority of agents will just submit an application to the company with the best rates and cross their fingers. This is the right strategy if you are in perfect health, ideal build and with no medical conditions. However when applying for life insurance with bipolar disorder there are lots of things we must do. First of you want to make sure you are working with an agent/broker who is independent and specializes in high risk cases. It is the agents job then to only work with companies that are highly competitive with bipolar disorder applicants. Before submitting an application we usually like to do whats called a quick quote. Quick quote is when you submit an anonymous scenario to the company, in order to get a pre-qualification letter from them.This will give us an opportunity to go with the company who will provide best outcome and have something in writing. In addition to that we usually write up a cover letter for more personable approach with companies underwriters. This will also help mention why you want the coverage, your lifestyle, alternative therapies that are working for you and anything else that can help you get better rates.

This is the part where we offer you to use our quote engine to get idea of the rates you might get. If you fall in the mild category of bipolarism feel free to use our quote engine on the right, just select standard rate class. If not please contact us for a custom quote at 888-492-1967 or chat with us if we are live. If we missed something or you still have questions, don’t hesitate to drop a comment below.