If you’re like most Americans who are completely lost and confused by insurance industry jargon and don’t know where to start when it comes to life insurance you’ve come to the right place.

If you’re like most Americans who are completely lost and confused by insurance industry jargon and don’t know where to start when it comes to life insurance you’ve come to the right place.

There are simply way too many different life insurance options and it can seem a little overwhelming.

However, we will look at all different types of life insurance and even figure out which one might be best for you. Picking out a life insurance plan is no joking matter because your family depends on it and I can’t tell you how many clients were in bad situations due to some agent who simply pushed a product on them without considering their needs.

Now if you want a simple understanding of what plans you should focus on if you’re looking for a simple pure protection life insurance without reading the whole article we can help. The two best plans in our opinion which are easy to understand and are not full of trickery are level term life insurance for temporary coverage or guaranteed universal life for a permanent option.

A term is very affordable with the ability to cover your family for a period ranging from 10 to 30 years and is ideal for young families. Guaranteed universal life is great for individuals who want a lifetime protection with fixed premiums and is popular among people who are over the age of 50.

But let’s not get too ahead of ourselves and let’s review all the different types of life insurance plans out there. By the way, if you read the entire article you are going to know more about life insurance than most agents and will never be at a disadvantage when buying life insurance.

7 Types of Life Insurance Policies and their Variations

There are 7 different types of life insurance policies that you can run into and each type has a variety of products under it. So let’s review further and see which one might be the right one for you.

- Term Life

- Permanent Life

- Group Life

- Simplified Issue

- Accidental Death

- Final Expense Life

- Guaranteed Issue Life

1. Term Life Insurance Policies

Most popular life insurance policy you probably already heard of. A level term policy is the most cost-effective way to buy a large amount of life insurance coverage for an affordable monthly premium. For example, a young couple in their early 30’s can secure a 30-year term for $500,000 around $35 per month. Half a million for $35? Sign me right up! Now let’s not forget that not all term policies are created equal so let’s see what are some available options.

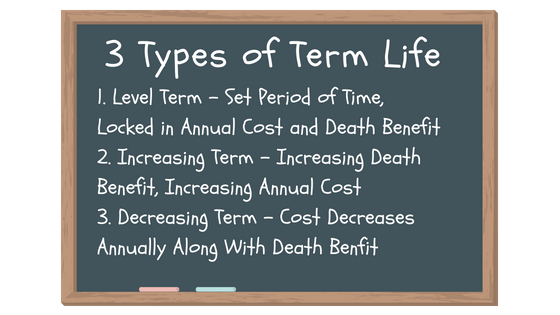

Level Term

This is the most common type of life insurance policy that you’ll run into and the one that we offer here at our agency. A level term is a fixed rate and death benefit coverage, which means that your policy will not change throughout the term. This policy can be acquired for 1, 10, 15, 20, 25 and 30-year term length periods. Whichever length of term you select the monthly payments will not increase and your coverage amount will stay the same. After the term expires your policy will turn into an annual renewable term up to age 95 but the rate will go up every year that you renew post initial term guarantee.

Most of the level term plans usually come with a conversion privilege which allows you to turn your plan into a permanent option like whole or universal life on guaranteed insurability basis. So in other words regardless of your eligibility, you can make that conversion. They also come with an accelerated death benefit rider at no cost which allows you to get up to 50% of the coverage amount if you have a terminal illness with 12 months or less life expectancy.

This policy also comes with some additional add-ons which can be purchased like child rider, waiver of premium rider, accidental death rider, the return of premium rider and disability rider. You can learn more about all these riders here.

Increasing Death Benefit Term

It is similar to a level term life policy except that the premiums and amount of coverage go up every year. This is ideal for people who want more coverage every year due to increasing need for coverage and to fight off inflation. So if you start with $500,000 policy for $35/month, in a year it may become a $525,000 policy with a premium of $40/mo and so on. If money is not a problem this can be an okay policy but most of the time our clients like to stay in the budget and don’t want their premiums going up every year.

Decreasing Death Benefit Term

Just like it sounds this is the opposite of the Increasing Death Benefit Term. With this type of term, your coverage amount will reduce over time to reflect your loan balance pay off. You have most likely heard of this policy more times than you think because this is exactly what mortgage protection life insurance is. The downfall of this policy is that although your coverage amount goes down your payments stay the same. A decreasing death benefit policy has its place but from our experience, you get a much better deal just simply buying a level term plan.

Summary: Term Life is one of the most bought policies due to affordability and simplicity. Perfect for young families looking to get a lot of coverage and pay little money. Its downfall is that the coverage does have an expiration date and if you don’t die within that period you would simply throw your money out. So if you’re getting life insurance to leave a legacy or cover funeral expenses this policy may be too much of a gamble.

2. Permanent Life Insurance Policies

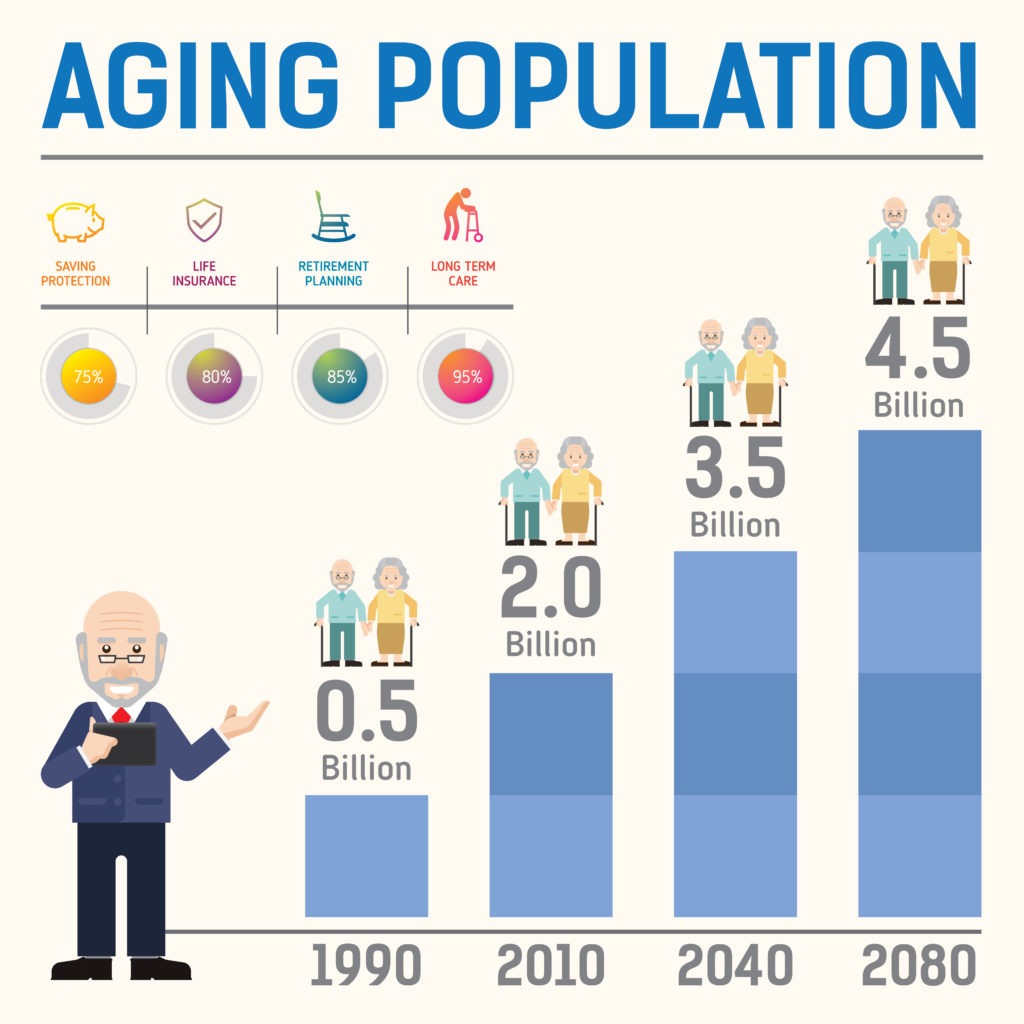

Opposite of a term life insurance plan, permanent life insurance policies are designed to provide lifelong coverage and have some form of cash value accumulation. Individuals who ask for this type of coverage typically have the money to pay for them since they cost a lot more than a term or just simply want to make sure that there will be a payout at one point or another. Be warned that there are many permanent types of life insurance but they are usually derivatives of whole and universal life insurance plans. With the growing aging population, and kids staying needy well into adulthood, permanent policies are becoming more popular. So let’s review different types of permanent life insurance.

Guaranteed Universal Life Insurance Policy

By far the best option for anyone looking to purchase a permanent life insurance policy. It was created for clients who wanted an affordable permanent protection that offered fixed premiums and simple to understand the concept. Unlike other permanent plans, this one doesn’t have a strong focus on cash value so you won’t become Warren Buffett but there may be some accumulation to take care of your premiums if you miss a few months or for small emergencies.

This policy can be locked in until age 100 and in some cases age 121 depending on what the carrier you work with offers. What makes this policy unique is the no-lapse guarantee which simply means regardless of how the market performs the insurance company can’t adjust your premiums. This policy is so stable and affordable we like to call it lifetime term, which is probably why it is the most sought-after product in our agency after term life.

Whole Life Insurance Policy

One of the oldest permanent type of life insurance and actually the first one to be out is a whole life policy. This policy offers a fixed death benefit with fixed monthly premiums and it matures at age 100. A whole life policy is good for people who want to have a guarantee in their premiums and death benefit along with some cash value accumulation.

There are two ways you can make money with your whole life policy. One way is every whole life policy takes a portion of your premium and allocates it in your cash value account within the policy where the funds accrued interest from bonds. The other way is policy dividends that get paid out to policyholders of a mutual insurance company where the policyholders are part owners of the company. In our opinion, you should only go for a whole life that has both cash value accumulation with premiums and dividend payouts.

Universal Life

After people were complaining about lack of flexibility of a whole life insurance, the insurance companies created it’s sibling universal life. Just like whole life this policy offers lifetime protection with savings element in the form of cash value. The big difference is that universal life is more affordable and allows you to make adjustments to your premium and death benefit.

The investments in a universal life policy are made into funds rather than bonds like a whole life. Unlike a whole life insurance policy, the policy needs to perform well with the cash value side in order to provide you with affordable premiums. If this is not the case your premiums may increase unlike a fixed premium as a whole or guaranteed universal life policy.

Indexed Universal Life

Another form of Universal Life Insurance that offers flexibility, cash value growth, and permanent coverage but the main difference being the option of investments you have within the cash value account. Most Indexed Universal Life policies give you an option to invest your cash value in equity funds. It can be the S&P 500 index or any other major index. What makes this policy special is that there is a floor which means that if the market returns go in the red, your policy won’t.

There is also a cap on how much you can earn from the index return and from our experience is between 10% to 14% depending on the company. If you’re looking to have permanent coverage and have good investment returns without having to become a chart analyst then an Indexed Universal Life Plan might be right for you.

Variable Universal Life

Same as any universal life policy but yet very different. This policy offers you flexibility and death benefit protection and a really high upside of cash value return if you know what you’re doing. You see with a variable universal life policy you get the tax benefits of life insurance while you can invest directly in stocks or any other high yielding investments with your cash value.

So if Indexed Universal Life is great for the passive investor then Variable Universal Life is great for the active investor who knows what he is doing. Otherwise, this policy can be dangerous if you lose too much money since it’s performance will affect the premiums. On the last note, as a life insurance expert, I can tell you that you’ll get the highest possible returns with this policy while still getting the tax deferral benefits of life insurance.

Survivorship Life

This can be either a whole or universal life policy that insures two individuals. Survivorship policies are very popular in estate planning cases since it only will pay out when both insured are deceased. In some cases, you can also set them up to if one of the insured passes away the other gets to collect the death benefit.

Although they have their place in certain situations these policies rarely get requested or asked about in our practice.

Summary: Permanent plans are requested since you will have life insurance for life and our leveraging your cash. These plans also accumulate cash value which is great since you can have some savings for emergencies or retirement. The downfall is these plans are very expensive and some people will be underinsured just to have a permanent policy. Also, do not buy the hype with 6% to 12% returns on the cash value and expect more of 1% to 5% while also keeping in mind that most of your premium is going to get eaten up by fees and commissions first 5 years of the policy. So compounding is definitely delayed! If you wanna play it safe and simply want to buy a permanent plan stick to Guaranteed Universal Life.

3. Group Life Insurance Policies

This is a life insurance plan offered through your employer and in some cases an association that you can be part of. In these policies, the group gets issued one master certificate and all other members join the group. The benefits of these policies are that the employer may be paying a large portion of your premium so you may be getting life insurance at a discounted rate. Another benefit is that there is a large pool of members so there is little to no underwriting to get approved for these plans which makes them attractive for people with pre-existing conditions.

The downfall, of course, is that if you ever leave the employer you may have to shop for an individual policy and you may or may not be in good health to qualify for a new plan. If your previous employer allows you to keep the plan you may realize that you have to pay much more now that they are not contributing anymore.

Summary: This option can be convenient since you can easily secure a policy and it can be very affordable since your employer contributes to the policy premium. It is also ideal for people with medical conditions since underwriting is laissez affaire. Be warned though, that if you leave employment you may lose coverage or realize how expensive it is without your boss paying some of the payment.

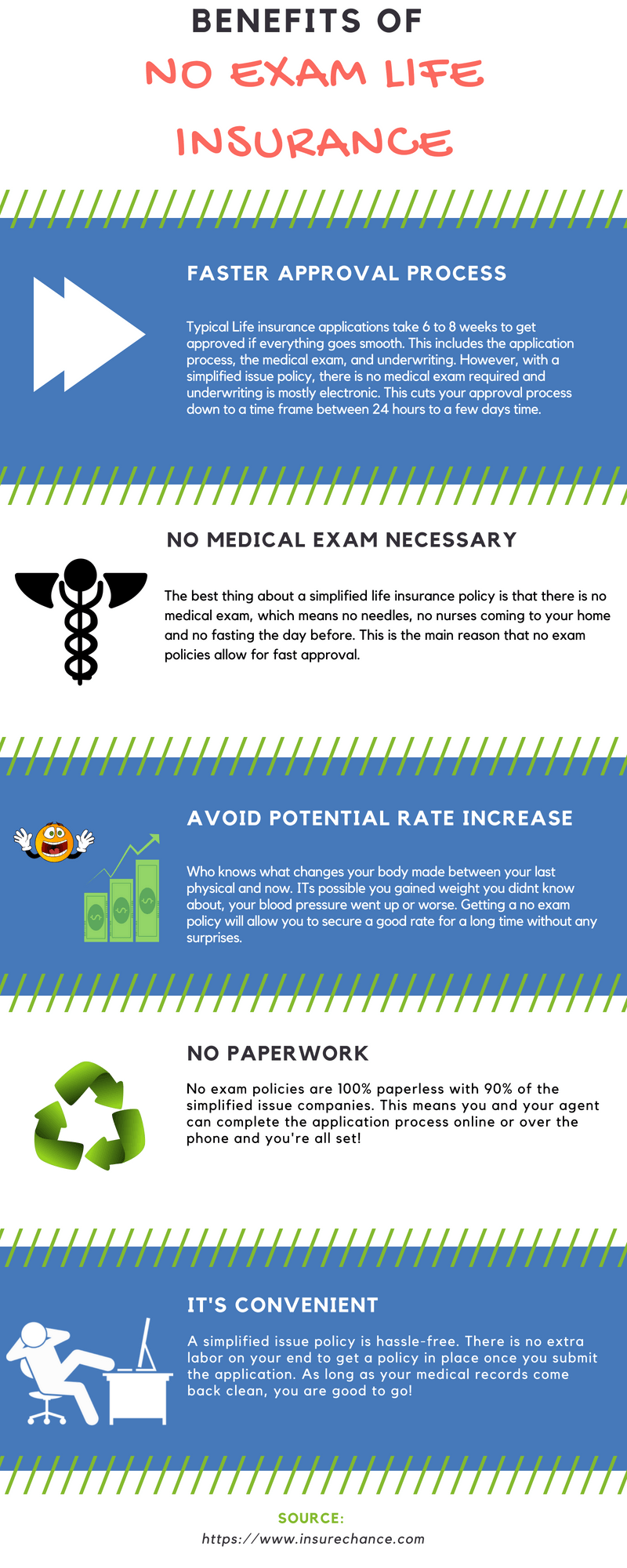

4. Simplified Issue Life Insurance Policies

This is a very popular type of policy these days with many people asking for them. A simplified issue plan was created to get rid of the average 4 to 8-week approval cycle along with a medical exam that you must go through in order to get a life insurance policy. With a simplified issue plan also known as no medical exam policy, you can secure a term or permanent plan up to $500,000 with an online application and no requirement for needles.

Of course, these policies cost a bit more but the convenience is really worth it. You can apply with “0” paperwork, no exam and get approved in most cases within 72 hours. It is good to note that even though there is no exam the company will still want you to be in good health as they will check the prescription database, medical information bureau, and motor vehicle history. For more information check out our detailed guide.

Summary: Perfect for busy people or those who hate needles and want a fast policy. It can help you save a ton of time by avoiding the medical exam. All you have to do is complete an electronic application with your life insurance agent and wait 24 hours to a few days to get approved. However, one thing to keep in mind is that it is not ideal for individuals who want to save the most, have medical conditions or need a large amount of coverage. In that case, you will have to go for a standard life insurance policy.

5. Accidental Death Life Insurance Policies

A life insurance policy that can be added as double indemnity to a regular plan or purchased as a stand-alone policy. This policy only pays in the event that you pass away due to an accident but not if you die from an illness or natural cause. Although we recommend you have a full coverage when it comes to life insurance in some cases, an accidental plan can work.

With Accidental Death Life Insurance, there are no qualifications so anyone can get approved for this plan. Most accidental death plans are available up to $500,000 and some companies will even let you get $1 million. If you are young and just need to get a policy fast to ease your worries then this can be a great choice. Learn more about how accidental death policies are different from regular life insurance here.

Summary: Quick and easy way to get rid of your worry of dying in an accident and probably one of the most sought out plans when fear of flying hits you. But beware that you are gambling since death can come in different circumstances and even if you were in an accident but died on the operating table due to an infection, guess what? Not covered!

6. Final Expense Life Insurance Policies

Small whole life insurance plans that are created for people who want to simply have enough coverage to pay for their funeral costs. They are very popular since you can get approved without an exam and by simply answering 10 to 15 medical questions. Most individuals who buy these policies have some pre-existing conditions and are over the age of 50. You can secure a whole life policy up to $50,000 depending on which company you choose to go with.

Summary: Great option to cover your funeral cost, however, keep in mind for anyone with good health you can get a better option. Also, prices vary largely from company to company so don’t just jump on the first offer.

7. Guaranteed Issue Life Insurance Policies

Similar to final expense life insurance due to the fact that they are whole life policies with small coverage amounts. A guaranteed issue life insurance plan is for individuals who have been turned down or are simply uninsurable due to severe medical conditions. With this type of policy everyone is approved without any questions or medical exams, however, the coverage is limited to about $25,000. In some cases we have clients purchase 3 or 4 different policies to get a higher amount of coverage although they are not cheap.

Summary: Probably the best thing for the people who get this plan since it is the last resort. Only note here is stick to companies like Gerber, AIG, Mutual of Omaha and Kemper Life as they have the best quotes.

What is the Best Type Of Life Insurance Policy?

The type of life insurance you need depends on your budget, your financial responsibilities, and what your goals are with acquiring life insurance coverage.

The type of life insurance you need depends on your budget, your financial responsibilities, and what your goals are with acquiring life insurance coverage.

*As mentioned before 90% of individuals are totally good if they pick a level term plan or a guaranteed universal life.

Your Budget

This is usually a good place to start because it will make it evident which type of life insurance you are actually able to get. Term life insurance is much more affordable than permanent life insurance simply because it’s a less likely possibility that the life insurance company will have to pay out the claim. That’s why the premiums for term life are much lower. However, if you can pay a little more we will always advise you to get a permanent plan that will definitely pay out at one point or another.

For example:

A healthy 43-year-old male, non-smoker, can acquire a $500,000 20 year convertible term life policy for 58$ a month.

That same male would acquire a $500,000 Guaranteed Universal life policy at $307 a month.

Big difference!

However, the person paying the Guaranteed Universal Life has the peace of mind that he is leaving a cool half a mil to his loved ones. The person with a term is thinking that he better have his affairs in order in 20 years so he won’t need to rely on life insurance.

If you have a limited budget I recommend getting a term life insurance policy to make sure that you have some coverage in place that you can afford comfortably and have the peace of mind knowing you have it just in case. As your situation gets better through promotions, better jobs or business growth, you can always opt for more coverage or convert to a permanent term GUL policy. Some life insurance is always better than none at all, just ask your family.

Your Financial Responsibilities

Now if you know you can afford your life insurance premiums consistently and make sure the policy doesn’t lapse than you have to consider your financial responsibilities. Life insurance is there to provide protection in the event of unexpected death. It’s always a good idea to buy a policy that would cover you in the case that you die tomorrow, but you also have to consider that some financial responsibilities are permanent. Trust me, in some rare cases like when you are debt free and have no dependents with all your other family members being well off, you don’t need to spend money on life insurance.

So if money is not an issue I recommend securing a permanent term policy now for all your permanent needs. Things like hospital bills, funeral expenses, and any legacy you want to leave behind. Now for all your temporary expenses like mortgages, you can secure a term policy for the length of time you think you would need it. This way you lock in a low rate for permanent life insurance, and you can have affordable coverage to make sure you have adequate coverage in the case of an unexpected death. Remember you can also convert the term policy and lower the amount coverage (which lowers the premium) at any time without proof of insurability.

Work with InsureChance!

If you can secure a permanent coverage for your permanent needs and a term policy for your temporary needs that is your best option. This is also best discussed with your agent so you can get the proper amount of coverage by doing a full needs analysis.If on the other hand you need coverage but can’t afford to do both, get more term coverage so that eventually you can convert it to a permanent policy and adjust the coverage accordingly to your needs at that time. Make sure you get an amount you can afford comfortably every month to keep the policy in force.

Here at InsureChance, we provide absolutely unbiased consultations to help you even if you don’t go with us. The reason is we are obsessed with improving peoples financial lives and not chasing commissions like most other agencies. We will search with over 60 different companies to find the right plan for you and your family. Call us at 888-492-1967 if you have any questions or Compare Term and Permanent life insurance quotes online.