As a modern consumer, you get bombarded with ads and opinion from your close ones about which company is the best or which products you should use. This only gets more confusing when it comes to picking a life insurance carrier because the pressure of ensuring you get the right company to protect your loved ones is immense. Not to worry though, here at InsureChance, we have reviewed 100’s of companies and happen to work with over 60 top rated life insurers so we have a pretty good idea of what it takes for a company to qualify as an option for our clients. You came to this article because you want to know if Ameritas Life Insurance Company is best for you. What I can tell you is that by no means the company is a scam or a fly by night. They are a reputable company with some great products, however, when it comes to life insurance it all boils down to what you need and what you qualify for. So let’s dig deeper and see what Ameritas is all about.

*If you already got a quote from Ameritas and want to see how they stack up against some other big companies, click here to compare quotes instantly.

About Ameritas

History

Ameritas has been around longer than our grandparents, 1887 to be exact. The company got it start in Lincoln, Nebraska by a group of businessmen who saw the big potential of insuring the fast growing country of the U.S.A. It was originally named Bankers Life until 1988 when they changed it to Ameritas. Because the company originated in the Midwest they chose the big red bison as their logo to represent! They went from a small insurance carrier to one of the biggest insurers in the country today which is a quite impressive feat.

Financial and Ratings

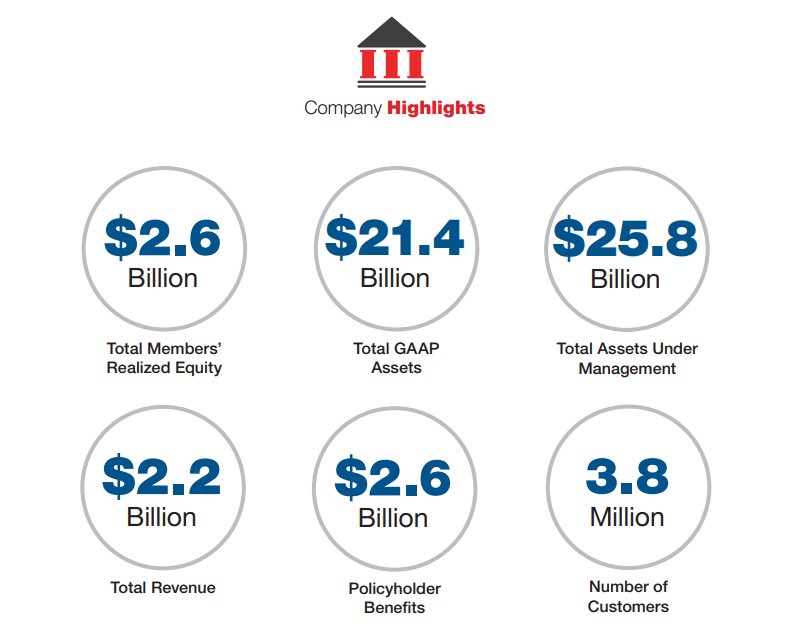

One of the most important things you can do when shopping for life insurance is to ensure that the company has a strong financials and positive grades from the rating agencies. When a company has a weak rating or not enough assets under managements it can easily go bankrupt if there is a large number of claims. There are many rating agencies for insurers but the main ones are Standard & Poor’s and A.M. Best. You’ll be glad to know that Ameritas Life has an “A+” (Strong) rating from Standard & Poor’s and “A” (Excellent) rating from A.M. Best. The company also has 3.8 million policyholders that trust them with their money, $25.8 billion in assets and last year their revenue was $2.2 billion dollars. Definitely not a company that you should sleep over wondering if they will be there to pay the claim.

Charitable

Let’s not list every penny or minute they dedicated to each cause because there will be many. Just know that Ameritas does like to give back to the community through monetary donations and employee volunteering which is always a good sign for a big corporation like theirs.

Reviews and comparison

Ameritas has “A+” rating from the Better Business Bureau which is amazing. They also only had 5 complaints which is great considering they serve 3.8 million people. It doesn’t seem like a lot of people had problems with them and we are basing this on all the other reviews we did. The company also takes great pride in their customer service so that may be the reason why there is not a lot of angry clients online.

This wraps up the section on the company itself and will focus on their products next. Based on everything that we see I advise that you use our comparison tool to see how they stack up against companies like Banner Life, Prudential, Protective, and Principal since those are worthy competitors.

Ameritas Life Insurance Products

Ameritas offers a ton of different insurance products for both individuals and employer groups but we are here to focus on life insurance. So let’s cover all their life insurance products one by one:

Term Life Insurance

Keystone Term

A form of temporary life insurance plan that is designed to cover you for a certain duration, typically ideal for young couples. You can lock the plan in from 1 all the way to 30 years based on your need. The premiums will stay locked in for the duration of your term with no surprises. This is the best way to secure the most coverage with the lowest monthly premium. This plan is convertible so you can elect to turn it into a permanent option like whole or universal life without any underwriting. You can also receive a large portion of your death benefit while you’re still alive if you have 12 months or less to live due to a terminal illness. You can customize the plan by adding riders like Child Rider, Accidental Death Rider and Waiver of Premium.

This plan is great for people looking to use it as mortgage protection, child college funding, and income continuity.

Permanent Life Insurance

Essentially a life insurance option that is designed to cover you until the moment you die. These plans are a lot more expensive and are available through Universal or Whole Life Options.

Universal Life

Universal Life Policy is a permanent plan that builds cash value from a portion of monthly premiums. This policy is flexible since it can offer you to change up your payments and choose a death benefit that increases over time. You can also borrow money from this policy once you have a substantial amount of build up in the cash value. There are also different types of universal life plans and they vary based on the investment set up of the policy. Here are all Universal Life Plans that Ameritas offers:

-Excel Essential UL

-Excel LifeValue UL

-Excel LifeValue Survivor UL

-Excel Index UL

-Excel Plus Index UL

-Excel Performance UL

Whole Life

Similar to a universal life policy this plan provides lifetime protection but doesn’t offer the same flexibility but has a guarantee. It too has cash value but it gets invested in bonds so it has less risk than a universal life plan. Here are different types of whole life plans from Ameritas:

-Ameritas Growth Whole Life

-Ameritas Value Plus Whole Life

-Keystone Whole Life

-Keystone Foundation Whole Life

* If you’re an average American looking to protect your loved ones simply stick with a term life or guaranteed universal life(pure protection with affordable rates for permanent option). The only time we recommend a fancy plan is for estate planning or business life insurance purposes. Otherwise, a pure protection plan with no gimmicks is the best way to go.

What we Think

Ameritas is a wonderful company and we really don’t have anything negative to say about them. However, there is no such thing as the best company for everybody. Each company will view you differently based on your overall health, lifestyle, family health history, occupation, hobbies, and background. For example, someone with type 1 diabetes will have a hard time getting approved with Ameritas or any other big company but MetLife will consider type 1 diabetics. It works this way all across the board with different companies. So what am I saying all this for, to let you know that you need to shop around. Life insurance rates are fixed by the law so you get the same rate anywhere you go. I think you should compare Ameritas with companies like Banner Life, Protective, AIG, TransAmerica, Prudential and Principal since their plans are similar and so is their ratings.

Work with Us!

Your next step after reading this article should be calling us or requesting an application on our comparison tool. We work with over 60 top rated life insurers to get you the best plan available. Our agents are the most knowledgeable and will guide you through the whole process without any sales pressure. Ameritas is a wonderful choice but why only shop with one company when you can compare the entire marketplace in minutes. If you’re a busy individual we also offer a wide range of no medical exam plans so you can get a policy within days delivered to your inbox. Whatever your need for life insurance may be we can help so please call us at 888.492.1967 or simply request more information. Welcome to the best online life insurance agency, InsureChance!