You’re probably got approached by an agent or were referred to John Hancock by a friend. Being a savvy consumer you want to ensure that your family will be able to collect the money from the carrier in the event something was to happen to you. The last thing you want your loved ones to do is to have to fight to get the money while they’re grieving over you.

You’re probably got approached by an agent or were referred to John Hancock by a friend. Being a savvy consumer you want to ensure that your family will be able to collect the money from the carrier in the event something was to happen to you. The last thing you want your loved ones to do is to have to fight to get the money while they’re grieving over you.

And in a nutshell, you won’t have to with John Hancock. However, before considering a life insurance company you need to check all other factors. This can include whether or not they are a right fit based on your overall health, lifestyle, family history and build. You also want to make sure that their product portfolio has a plan that can meet your needs and budget. All in all John Hancock is a great company but you should totally read this article to see if they are a right fit.

Quick Answer: If you don’t want to read everything on this page, we have a pretty good idea what has brought you here. So if your only concern is whether you can trust John Hancock or not, the answer is absolutely YES! This is one of the most reputable life insurance companies on the planet. Not only have they been around for over 100 years but they also have amazing products and services. Working with over 60 top-rated companies we can tell you that John Hancock is in our top 10. Now, this doesn’t mean that they will be the best for your overall health or circumstances, so be sure to speak to one of our agents first. We will give you a comprehensive quote from the most suitable companies for you.

About John Hancock

Company History

This company is truly a dinosaur since they are one of the oldest around. They actually got established back in 1862. It was named after the famous US Patriot himself. John Hancock had humble beginnings but grew quickly due to their focus on integrity and quality products. Today the company has brand recognition throughout the world. In the U.S., they have a huge market share not just in insurance but also financial products.

Originally founded in Massachusetts the company headquarters remain in that state till this day. That may explain the reason why they have such a large involvement with funding charities, Boston marathon, and other large projects in the area. In 2004, they have merged with a Canadian company called Manulife Financial but still operate as a separate entity.

Rating

One of the easiest ways to see if the company you’re planning on working with has the ability to pay claims is their rating. It gives you a summary of how strong their assets are, their investment strategy and the amount of risk they take. A company with a good rating has a great balance of all three. You’ll be pleased to know that John Hancock has some of the best ratings from all major rating agencies.

Most Popular One is A.M. Best and they gave John Hancock an “A+” which is excellent. Here are other agency grades:

S&P “AA-”

Fitch “AA-”

Moody’s “A1”

This gives you insight in knowing that the carrier is highly rated and has a strong claims-paying ability. Still not convinced, they have close to $500 billion dollars in assets thanks to millions of loyal paying policyholders.

Giving Back

If you’re like us you want to work with companies that mean well. The best way to see if that’s the case is by seeing if the company gives back. And this company does just that. Through their signature corps volunteers, John Hancock employees volunteer at over 100 projects annually. Their contribution to Boston, Massachusetts is paramount and highly recognized by the local community. Besides giving their time they also have donated millions of dollars to various charitable organizations.

Customer Service

From personally dealing with them, we can tell you that their customer service is top-notch. You can usually get a live person on the phone within 5 to 10 minutes to assist you with any of your policy needs. The customer service personnel is knowledgeable and friendly. You should know that if you work with the right agency they actually provide most of the service. Which means you really shouldn’t be calling the carrier anyway.

Another way to see what customers think of a company is to check their Better Business Bureau. Upon our investigation, it seems like they have an A+ rating and almost all of their complaints are resolved. Now you may be wondering are they the best in service, and the answer is “NO”. They are a few other companies that we think have better customer service but as mentioned before, your service point should be your agent.

Company Website

As an independent agency we work with a ton of life insurers and one thing we can tell you is that most life insurance carriers are stuck in the stone age. Their websites are old, confusing and don’t provide the ability to view your policy online. That’s why we dedicate a paragraph on this when reviewing carriers. John Hancock, on the other hand, has a very modern, responsive and easy to use the website. At their website, you can learn all about the different products they offer and even log in to manage your own.

Overall, when it comes to John Hancock’s financial strength, service, ratings, and the history they are one of the best. But that’s only a small portion that you have to consider before picking a company as your favorite pick.

John Hancock Products

They offer a large array of products but since you’re here because you were interested in their life insurance that’s what will focus on today. You won’t find a lot of information on their life products on their site but they do provide a comprehensive brochure to agencies like ours. So will get into detail as to what is available from their line up.

They offer a large array of products but since you’re here because you were interested in their life insurance that’s what will focus on today. You won’t find a lot of information on their life products on their site but they do provide a comprehensive brochure to agencies like ours. So will get into detail as to what is available from their line up.

Like most large companies you will find both term and permanent life insurance plans. Just so you know the term is temporary coverage that is very affordable and provides coverage for a set period of time. Usually for 10 to 30 years after which it will expire. Another type is permanent which is locked in for a lifetime but as you guessed cost much more than the term. Permanent plans go by different names like Universal, Indexed, Whole or Variable Life. John Hancock offers term, universal, indexed and variable universal life. So let’s review them:

Term Life

This is a level term coverage which means that your rates will be fixed for the duration of the term. So you don’t have to worry about your premiums going up anytime during the term. Their term plan offers a length of up to 20 years. Which is great if you’re 45 and need cover until retirement or your kids are at least 5 years of age and up. For someone who is in their 20’s and 30’s with a goal to get protection to pay off their mortgage, this may not work.

This is also probably a big reason why we notice the clients who do go with John Hancock are typically older. Another reason is they do have some competitive approval guidelines for certain medical conditions or high-risk occupations.

*If you are looking for a high face amount coverage like anything from $1 million to $50 million dollars of life insurance John Hancock will be very competitive with their rates. That combined with the fact that this is one of the most reliable companies, their term life product is a great fit for high net worth clients.

Additional Perks Available with John Hancock Term

Just like most other term life policies John Hancock offers various add-ons. Some are automatically built into the plan others you have to pay extra for. For instance, there is a conversion privilege which allows you to convert your term policy to a permanent plan without proving insurability. (free benefit)

Here are some Optional Benefits:

Total Disability Waiver– this waiver will keep your policy in force in the event you become disabled. The policy will be paid for and stay active the entire time without you having to pay out of pocket. It may add a few dollars to your premium but it is perfect for people that have a healthy paranoia about being uninsured.

Accelerated Benefit– one of my favorite add ons which is free of cost and is a must. This rider will give you up to 50% of the death benefit in the event you have a terminal illness with one year or less life expectancy. The best part is that if you beath the illness you don’t have to pay the money back. So if you were in a group of people who thought life insurance was only good when you die, surprise!

There are few others which from our past interactions with clients are not in high demand. Besides, let’s leave something for you to talk about with our knowledgeable agents.

Permanent Life Insurance

If you are more concerned with leaving something behind regardless of when you pass or are interested in wealth transfer there are options. John Hancock overs a solid portfolio of permanent life insurance plans that will cover you for a lifetime plus provide some cash value growth. They offer a universal life, indexed universal life and variable universal life insurance plans. Now, we can go ahead and write a book about permanent plans with investment focus but if that’s you’re interested you are better off with speaking to one of our advisors.

However, what we must cover is their no-lapse universal life product due to it being the best alternative to those who don’t want term.

John Hancock Guaranteed Universal Life

This is one of the most popular products for folks who want affordable lifetime protection with simplicity. Also known as a lifetime term, a GUL policy allows your death benefit and premiums stay level until age 90,95, 100 or even 121 depending on your preference. If you’re looking to build cash value this plan is not going to impress you. However, you’ll be happy to know that this plan is the most affordable permanent life insurance option. It does have some cash value growth that you’ll have access to in the event of small emergencies or simply to pay your premiums.

You may be wondering how do you know when this is the right product for you. Here are some common scenarios where a GUL makes sense:

- You want coverage longer than the maximum term length of 30 years.

- You need life insurance for estate planning.

- You feel like a term policy might be a waste of money and don’t want to gamble.

- You’re looking for a final expense policy but are healthy so you’ll save a lot more money on your premiums.

- You’re the type of person that wants to be covered for a lifetime.

For most individuals John Hancock’s Term Life and GUL plans are perfect. This is why we cover them both in-depth. If you’d like to get an idea of how much they will cost you, our quoters offer both term and permanent quotes.

John Hancock Vitality Program

Ever felt like it was unfair to you to pay the same rates as everyone else since you take great care of your health. Well, there is good news! John Hancock is the first company to roll out their Vitality Program for both their term and permanent life insurance plans. Basically you can save an additional 15% on your annual life insurance premium by accumulating vitality points. The way this works is you’ll be provided with a free fit bit device or you can use an apple watch if you prefer. Your wearable device will track any exercise that you do which will turn into points. On top of this, you’ll also be rewarded for getting your routine physicals, buying healthy groceries and watching health-conscious educational videos through their app. All these activities provide you with an accumulation of points that later on can be used to reduce your life insurance premiums and earn rewards.

You can learn more about the program here or simply watch the short video about this revolutionary program.

John Hancock Sample Quotes

Unlike many other insurance sites, we are not going to create a boring table with a bunch of rates for different face amounts. Because you can simply run a no-obligation quote right on our website for John Hancock and many other carriers. Instead, I’d like to show you how this company compares to others and how they become more competitive at higher coverage amounts. Just to let you know, we’re going to use a healthy 45-year-old nonsmoker male in good health not perfect so preferred rates and not preferred plus. (unicorn rates that few people get)

First off let’s start with $250,000 20 Year Term Plan– John Hancock is coming in at a higher side at $37.76/mo versus $32.02 for Pacific Life which is the lowest rate you can get. This might only seem like $5 per month difference it can be much more once you start getting a higher risk class like standard or substandard. In the quarter-million-dollar amount, John Hancock is not as competitive.

Now let’s try $500,000 20 Year Term– Here is when John Hancock starts kicking some behind. First, the showed up numero uno at $53.01/mo if you go with the vitality option we discussed in the previous paragraph. If you don’t then it will be $59.41/mo which is still very competitive considering the second-best rate after John Hancock with vitality program is Pacific Life at $57.19/mo.

How about $1,000,000 20 Year Term – Once again they are number one with their Vitality Term at $97.16/mo, Pacific Life at second place with $105.52/mo and without Vitality, John Hancock is still in top ten lowest rates at $109.56/mo

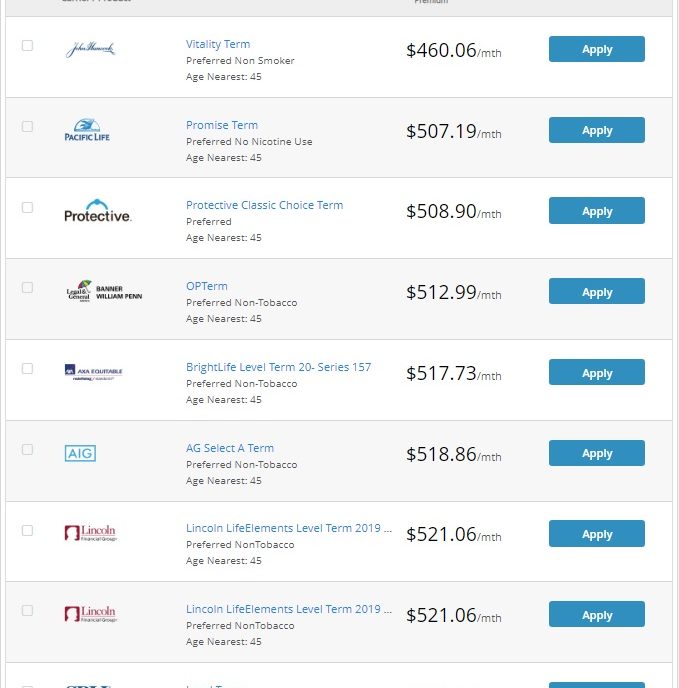

Here is a screenshot of $5,000,000 20 Year Term- The higher the face amount the more savings you’ll be able to get with John Hancock.

Anything over $250k and with their vitality program shows John Hancock as the most competitive carrier for the preferred rate. Quite honestly this has surprised me myself since I don’t really pay that much attention to it on a daily basis. However, if you need less than $250k you’d better off with other carriers.

John Hancock Pros and Cons

Pros

One of the biggest pros of going with JH is their reputation. This is one big insurer that has been around for a very long time and has paid billions in claims. They also have a very strong financial rating along with high reserves. Another big plus of theirs is that they are extremely competitive at higher face amounts. So if you’re looking for a life insurance policy over $1 million, they will probably be your carrier of choice. They are also more liberal with high-risk conditions than most other carriers. If you have a high-risk occupation or a medical condition, their underwriting department will do their best to give you a fair offer. And they have outstanding customer service with friendly live personnel on the other side of the phone. Overall, there are a lot of reasons to consider John Hancock as top 10 out of 100’s of life insurers.

Cons

Some of the downfalls of this company only would appear obvious when matching them against best carriers. Otherwise, most individuals wouldn’t really think of them as a con. One of the downfalls of John Hancock is their short term length of 20 years when most other carriers offer 30-year term lengths. Also, they tend to be a bit pricier if you’re getting coverage for less than $1 million or will get a health rating other than preferred. Speaking of health ratings, the underwriting of applications in some cases takes a very long time. So if you’re someone with a higher risk and want a life insurance policy sooner than later it might make sense to shop around.

Application Process

In the event that you decide that John Hancock is the company for you, prepare yourself for the application process. John Hancock has two ways of applying and getting approved for coverage. Let’s cover them both so you know what to expect.

Option 1 Accelerated Underwriting- No Exam Up to $3,000,000

Yes, you read that right! John Hancock will give you up to $3 million in life insurance without a medical exam and at a faster approval time if you qualify for it. If you are in overall great health with regular doctor visits and no dangerous hobbies then you may be a candidate.

With this option, an agent would submit a drop ticket which is pretty much a very short form with your info to John Hancock. Afterward, you’ll have to complete a telephone interview at which point they will also pull your information such as RX records, Driving History, Criminal Background, and other important criteria. Once they have all the information and a complete phone interview they will let you know if you qualify for the no exam approval process or have to go through the traditional route. By the way, it should also be noted that getting this much life insurance without an exam is unheard of, so if you’re one of the lucky few definitely go for it.

Option 2 Standard Application Process

In the event you don’t get cleared for Accelerated Underwriting or need more than $3 million of life insurance there is a standard process. This involves filling out an application with your agent and signing it. Once that is done, you’ll have to complete a medical examination where a nurse will come out to your house to draw blood, urine and check your build. When this all gets submitted the insurance company will also pull all your records and give you a decision within 4 to 6 weeks.

From what you have gathered so far it is quite clear that Accelerated Option might be a much better choice. So be sure to let your agent know that you’d like to see if this is a route for you.

So what’s the Verdict?

If you’re in the market for life insurance and John Hancock is one of your picks then I can easily say feel free to get the application started. This is one of the oldest and most recognized insurance companies in the entire marketplace. If you’re in great health then you should definitely go with this carrier since you’ll be able to skip the medical examination and get a rapid approval.

However, as an independent agency that works with John Hancock and 59 other top-rated insurance carrier it is our job to tell you to compare rates. There are some scenarios where you may want to go with another carrier. One of which is that you may get a better health rating with another carrier which in turn will provide lower rates. An example would be someone who gets rated higher with John Hancock due to certain build but gets a better rating with let’s say AIG. This can also be seen with certain medical conditions, dangerous occupations, and crazy driving history.

Whatever you decide, I’d like to share with you that we are the leading online agency that specializes in getting you the most competitive rate from reputable companies. Not only can you shop around by using one of our quoters yourself but you can also call one of our experienced agents. They are able to find the best deal for you by looking over all the underwriting guidelines of various companies so you don’t have to waste time guessing. Call us today at 888.492.1967 click here to compare shop yourself.