There’s a reason why life insurance seems so expensive when you’re applying for the first time at an older age: companies use mortality tables to determine the cost of premiums and older individuals represent a higher risk to the life insurance carrier. Being smart and taking a look at your life insurance options earlier rather than later can lead to huge benefits for you down the road. Plus, it is better when you have that coverage locked in earlier since you’ll get a better premium anyways and not have to worry about what would happen to your family in the event of a worst case scenario. Let’s take a look at how Jim, a life insurance applicant with great health, and Carol, a life insurance applicant with standard health, might look throughout the course of their lifetime. Before we talk about Jim and Carol we will break down age brackets of life insurance quotes by age and then we will go over the examples of quotes of the applicants and analyze the results.

*Note: These are based on premium costs as of today, which is subject to shift at the will of the life insurance carrier. These quotes are provided as samples only to give you an idea of what life insurance coverage might cost at different ages based on current rates. Coverage at these rates not guaranteed.*

Feel free to run yourself a quote on the same quote engine we use in the examples here: Term Life Quotes. The following are some key points from this article;

- For most 30-year olds, life insurance will never be cheaper than it is today. For example, if you are a 35-year old in perfect health and want to buy a $250,000 20-year term life insurance policy you are looking at about $14 a month.

- If you are in your 40’s you probably are starting to realize that your kids are getting older and your house is getting bigger which means that your life insurance needs have changed as well. For example, if you are a healthy individual who is 45-years old and looking for a face amount of $250,000 you are looking at premiums around $17.

- For a healthy individual that is 55-years old looking for a 20-year term length with a face amount of $250,000, you are looking at $42.58.

- If you are in your 60’s you are probably thinking it’s too late to get life insurance but the good news it isn’t too late. Maybe you realized recently that you need life insurance because your kids are grown and maybe have kids of their own (your grandchildren) and suddenly you figured out how important it is for you to get life insurance for their sake. The last thing you need to worry about is the expenses that follow after your death. If you are healthy and don’t smoke and want a $500,000 face amount for 10-years you are looking at for women $989 annually and for men $1,476 annually.

- The good news about being 70 and above is that you are around to see your grandchildren and seeing your children love them dearly, but you are realizing more and more that you need to buy a life insurance policy because you don’t want them to have to worry about all the financial burden that can be caused after your death. Plus, it’s never too late to buy life insurance, just don’t expect your life insurance rate to be the same as a 30-year old.

Life insurance rates at age 30-40

If you are reading this then you fit in between this bracket and probably had an epiphany and realized that life insurance right now is super important. The good news is that you are totally right and another good thing is that you are still considered young. You are either just beginning to have children or you already have your set of children and probably just bought a house or are about to buy a house. For most 30-year olds, life insurance will never be cheaper than it is today. For example, if you are a 35-year old in perfect health and want to buy a $250,000 20-year term life insurance policy you are looking at about $14 a month. If you are in your 40’s you probably are starting to realize that your kids are getting older and your house is getting bigger which means that your life insurance needs have changed as well. The bad news for those in your 40’s your rates will reflect that because statistics show that after your 40’s people suffer from more accidents or diseases such as heart attacks and more, sadly. For example, if you are a healthy individual who is 45-years old and looking for a face amount of $250,000 you are looking at premiums around $17.

Life insurance rates 50-60

Now that you have got into this bracket you should already know what time it is. For those of you that are in your 50’s, it’s not going to be the same ratings as of a 30 or 40-year olds with amazing health because as you turn 50 you can’t help but see some health concerns, it’s inevitable. Just try to remember if you have developed a health condition you should be aware of the fact that every company treats a particular health concern differently and some may be lenient but others may deny you for something like diabetes. For a healthy individual that is 55-years old looking for a 20-year term length with a face amount of $250,000, you are looking at $42.58. If you are in your 60’s you are probably thinking it’s too late to get life insurance but the good news it isn’t too late. Maybe you realized recently that you need life insurance because your kids are grown and maybe have kids of their own (your grandchildren) and suddenly you figured out how important it is for you to get life insurance for their sake. The last thing you need to worry about is the expenses that follow after your death. If you are healthy and don’t smoke and want a $500,000 face amount for 10-years you are looking at for women $989 annually and for men $1,476 annually.

Life Insurance Rate at age 70 and above

The good news about being 70 and above is that you are around to see your grandchildren and seeing your children love them dearly, but you are realizing more and more that you need to buy a life insurance policy because you don’t want them to have to worry about all the financial burden that can be caused after your death. Plus, it’s never too late to buy life insurance, just don’t expect your life insurance rate to be the same as a 30-year old. If you are a healthy individual with no health problems and have lived a very healthy lifestyle then you will be getting the best possible rates available for this age!

You can look into a guaranteed issue policy which does not require you to have a medical exam whatsoever. You can also look into a final expense policy which has a purpose of covering all the costs associated with death. The costs associated with funeral, admin fees and final medical bills. The top nine best life insurance companies for seniors are as follows;

- AIG

- Sagicor

- Principal

- Prudential

- Metlife

- North American Company

- Phoenix

- United Home Life

- Mutual of Omaha

Jim’s Life Insurance Quotes

Stage One: Age 25

Although there are not many 25-year-olds on board with getting life insurance, there certainly should be. When you’re young and healthy, the life insurance carrier is banking on you living a long time. Especially when it comes to term life insurance, you could lock in a great low rate early on and not have to worry about reviewing your coverage for a little bit. One way to save on your insurance is to pay for it annually, but since most people earn monthly or biweekly paychecks, we’ll explore quotes with the extremely simple monthly bank draft quote. When you’re being billed by monthly bank draft, the carrier simply pulls your premium out each month, leaving little room for error. You’re unlikely to forget a payment or experience lost checks in the mail when you pay monthly through your bank.

Stats:

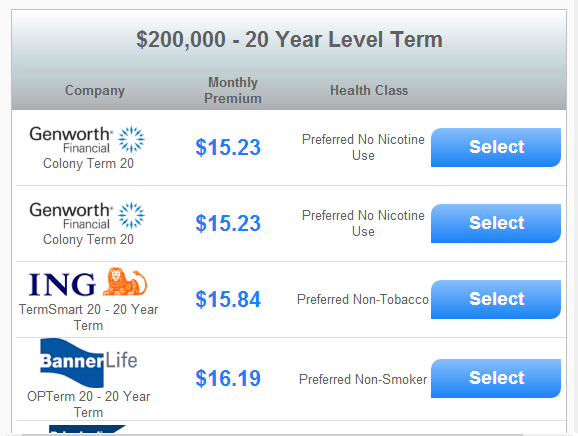

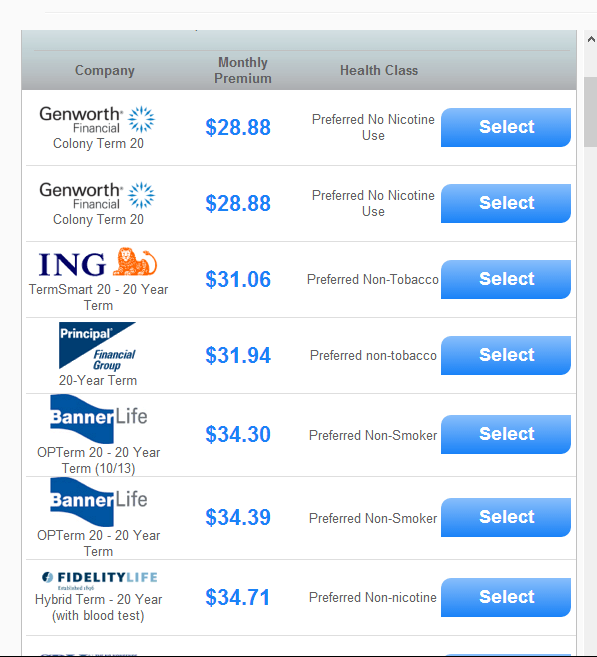

Jim, age 25. Nonsmoker in excellent health getting a quote for preferred best. Looking for $200,000 in coverage. His state is Ohio and he is looking at about twenty years of coverage.

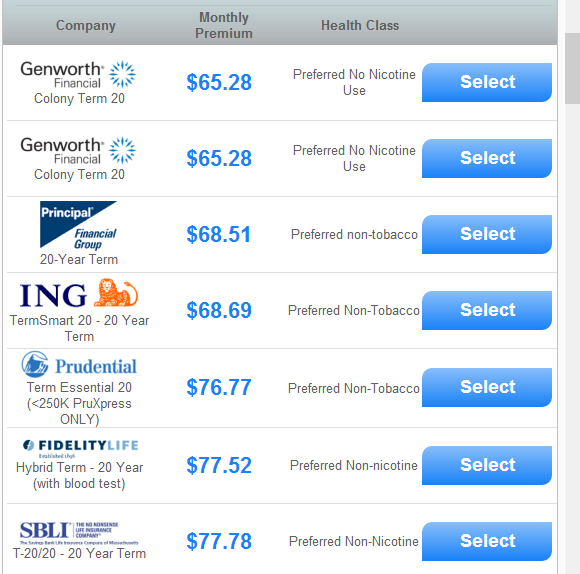

Even though this coverage will keep him protected until age 75 without conversion, it’s really expensive! Plus, when he’s closer to a conversion, his older age might make his universal life premium be higher than if he had selected to purchase term earlier and convert earlier.

Perhaps you’re thinking “Okay, that’s great, but Jim’s in perfect health. He’s always going to have pretty reasonable life insurance premiums.” So let’s take a look at someone who starts off with standard health but maybe develops some health issues over time. This really helps to illustrate how purchasing life insurance early can help you “hedge” against the future risk of illness or other problems that might make a purchase of life insurance more expensive.

Carol’s Life Insurance Quotes

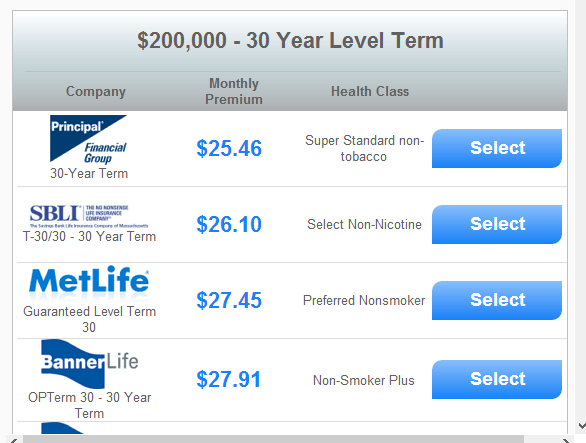

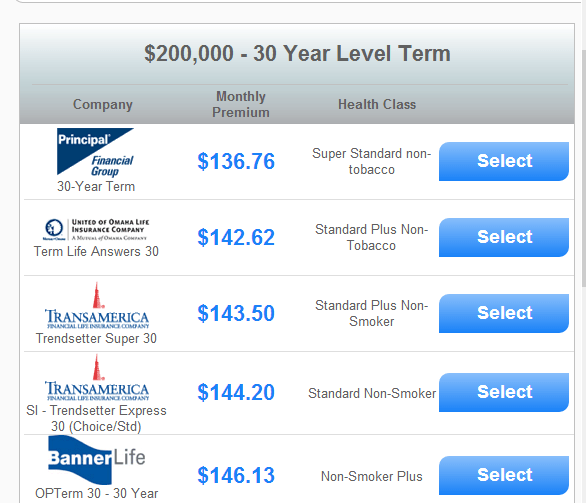

The Stats: Carol is looking for about $200,000 of coverage, too, but she wants at least 30 years of protection in Florida. Unlike Jim, she starts off in decent, but not great health, due to her height and weight. She is classified as a standard plus risk. At age 30, she starts thinking about whether she should get life insurance to protect her children.

This is reasonably affordable and would be easy for Carol to swing. She still isn’t sure that she wants to move forward with the actual purchase, however, so she waits another twenty years, until she is aged 50, to get coverage. During this time she has developed some blood pressure and cholesterol issues that bump her down to standard risk class.

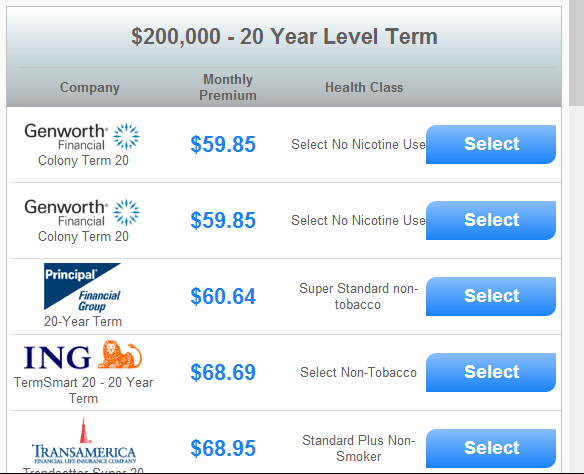

Wow, to get thirty years of coverage at age 50, Carol’s premium has increased dramatically. She decides to see how she can bump the length of coverage to twenty years.

Work with us!

As you can see, health and age are two of the most important factors in determining the cost of life insurance. Get started with the life insurance quote process today to see how much this valuable protection will cost. We believe anyone can get a life insurance policy regardless of age whether term, whole, guaranteed issue, or final expense insurance. Just keep in mind that depending on your age your rates will change. So like we said before, you are not getting younger, therefore, there is no time better like today! You can also give us a call and use our free service, we are an independent life insurance agency here to do all the shopping for you. We work with over 60 top “A” rated companies and have a big selection to choose the best life insurance company for you! Don’t hesitate to give us a call or leave a comment below.

If you have any questions please call us at 888-492-1967 or Compare Affordable Life Insurance Quotes Online.