There are a lot of life insurance products on the market and trying to figure out what is what all on your own can be confusing. That’s why I’m here. My goal is to dispel the confusion that comes from all these different named products offered by all of these different named life insurance companies. Essentially most of the products offered out there by life insurance companies are the same at their core. One of the most popular of these products is term life insurance. Among them, there is a level term policy and a decreasing term life insurance policy. Let’s talk about what decreasing term life insurance is, when it makes sense to buy it, and when it doesn’t. The following are some key points from this article;

- Decreasing term life insurance is a term life insurance product that decreases in coverage amount over time, which in turn causes a decrease in premium. You can expect the death benefit amount to decrease along with your premiums the further into the term you go.

- If you the only reasons you are getting a life insurance policy is to make sure your mortgage is paid off in the event of your death, then a decreasing term life insurance policy makes perfect sense.

- Similar to a mortgage, most loan companies will require you to have life insurance in place in order to approve you. If you don’t want them receiving the whole death benefit amount when you’re more than halfway through the loan, then you can either set up a trust or more simply, buy decreasing term.

- There are other options in the form of level term life insurance. Level term life has one locked in premium rate for the entire length of the term.

- A decreasing term life insurance policy is a bad idea if you have anyone depending on your income. If you have a spouse and kids that need to go to college, your need for life insurance stays intact for a long period of time.

- You should always work with a knowledgeable agent who can advise you on what the best route for you is. But as I mentioned earlier if you have people depending on your income then decreasing term life is a bad idea.

What is Decreasing Term?

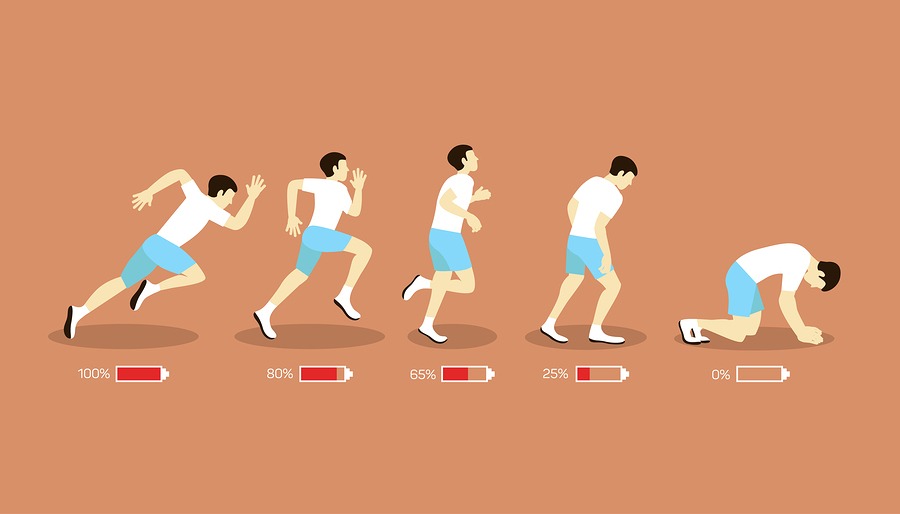

Decreasing term life insurance is a term life insurance product that decreases in coverage amount over time, which in turn causes a decrease in premium. You can expect the death benefit amount to decrease along with your premiums the further into the term you go.

Like a regular term life insurance policy. You can pick the term for a decreasing term policy. Meaning you can choose if it decreases over 10, 20 or 30 years until it gets to 0. The logic behind these type of policies is that as time goes by your need for life insurance decreases. But is that really the case? Well, it can be.

When Decreasing Term Makes Sense

There are a few situations where a decreasing term life insurance policy can make sense and it usually revolves around debt.

Your Mortgage

If you the only reasons you are getting a life insurance policy is to make sure your mortgage is paid off in the event of your death, then a decreasing term life insurance policy makes perfect sense. This is because you consistently pay down your mortgage, your coverage amount should match that of your leftover balance. In fact, decreasing term life insurance policies are often sold under the “mortgage protection life insurance” product category.

Loans

Similar to a mortgage, most loan companies will require you to have life insurance in place in order to approve you. If you don’t want them receiving the whole death benefit amount when you’re more than halfway through the loan, then you can either set up a trust, or more simply, buy decreasing term. Your coverage amount can be found too for the loan payment arrangements.

When it Doesn’t Make Sense

A decreasing term life insurance policy is a bad idea if you have anyone depending on your income. If you have a spouse and kids that need to go to college, your need for life insurance stays intact for a long period of time. For the most part, it can even increase as time goes by. Maybe you had an increase in salary or the kids desire a more expensive education. Whatever the case, you may want to look at other options if there are people depending on your income.

Are There Other Options?

There are other options in the form of level term life insurance. Level term life has one locked in premium rate for the entire length of the term. So if you have a 20-year term life insurance policy, your rate will stay the same for the 20 years until the policy expires. Once the policy expires you can either convert the policy to a permanent one or renew it annually at your new age, without having to take another exam and prove good health.

What Should I Do?

You should always work with a knowledgeable agent who can advise you on what the best route for you is. But as I mentioned earlier if you have people depending on your income then decreasing term life is a bad idea. However, if you are getting life insurance purely to secure a mortgage or a loan, then it may not be a bad idea if you’re not looking for coverage outside of it. Make sure to always shop around with all the companies to get you the best rate out there. It may sound like a tedious process, and it is. But there is good news, you’re at the right place.

What about level term life insurance?

A lot of people can’t decide between getting level term life insurance or decreasing term life insurance.The real decision is yours, of course, the power is yours! But we are here to clarify what level term life insurance means. Many agents out there will tell you that decreasing term can be a waste of your premiums but that really depends on what company you work with and your specific needs, maybe you really NEED this type of insurance. However, a level term life insurance policy your premiums will remain flat. You no longer have to worry about your term premiums going up because it won’t a level term life insurance policy. The product that’s better for you will completely depend on your goals and needs for life insurance. However, there are certain advantages that level term has over a decreasing term option. The level term policy, you are offered the option to convert the policy at the end. A decreasing term just expires once the term is done and its worth next to nothing close to the end of the term. As far as a pure protection goes, level term life insurance. Where decreasing term wins is eventually it costs you less, but that’s because it also provides less value.

The trick is that your death benefit will go down as your premiums remain flat. Often times you are better of getting a level policy so both your rates and benefits will stay the same and the cost is same or better in certain cases.

Work with us!

Whether you decide to purchase a decreasing term policy or a permanent policy you should still consider working with us! Either way, you decide to go you need to keep in mind that the best way to assure that you are getting the best rate possible is by shopping around for quotes and comparing companies. We’re an independent life insurance agency that shops around with all of the life insurance companies on your behalf, at no extra cost to you! We represent over 60 A-rated life insurance companies and know what to do to point you in the right direction. Our independent status means we are not tied to any one company and our loyalty is only to you, the consumer.

Did we forget to mention that our services are 100% FREE and FREE of obligations? Did we say FREE enough times? Instead of DIY, doing it yourself, you should give us a call and let us do all the hard work for you! Not only will we shop around for quotes and compare companies for you until we find the best company that reflects your specific needs, health, and lifestyle but we will also fill out the necessary applications for you! If you have 30 seconds go below this article or click here, and fill out our super quick quote engine so you can see yourself what different “A” rated companies have to offer. It’s like that saying “killing two birds with one stone” you get to check out quotes and compare companies all in one with our quote engine.

However, here at InsureChance, we understand the value of time, there is not enough time in the world to enjoy with the ones who matter and that is why we offer these services, we want to give you back the time you deserve so that you can spend time with those who matter the most, your family.So if you have any questions regarding decreasing term life insurance, level term, or anything else, call us at 888-492-1967. Or you can hit the chat button below! Welcome to InsureChance!