So you’re not a fitness buff and are wondering how your build will affect your rates. The good news is that most life insurance companies give a lot of leeways to keep you at favorable rate classes when it comes to build. Rate classes are what a company will assign to you based on your overall risks such as your build, health, family and background history. In this case, we are focusing on the build. The rate classes range from preferred plus, preferred, standard plus, standard and substandard which ranges from table 1 to table 10. Each table represents a 25% increase in the monthly premium when compared to standard rates.

When looking online for information you will find a lot of the sources that make it seem like their company or information is the end all. This is quite misleading since there are other things such as age, gender, plan type and company applied for that will differ in what is the acceptable build. For example, males can have a higher weight than a female applicant for the same height. Also, people over 70 have a higher maximum allowed which enhances chances of qualifying for better rates. And keep in mind that even if you get a better rate class with company A it doesn’t matter if company B can have better rates. For example, if you got rated standard and your payment is $35 per month, you would still pick that option even if another company offered preferred plus at $41 per month. The key is to find the companies that will give you the lowest rate regardless of the actual rate class assigned. That’s why it is a must you work with an independent agency to get the most savings.

If I was to give you the ultimate way to get accurate information and quotes based on the build it will be this. When we work with a potential client we use our quote engines tool called “Xrae” to take out the guesswork. This tool will give us quotes from all the companies starting with the lowest premium by using gender, build, amount applied for and plan type. This is the best way I know to get accurate quotes and ensure you are saving every penny possible.

What if I lose weight?

If you lose weight in the future most companies will reconsider the rate class they originally assigned. Keep in mind that if you lost weight within the last 12 months you only get credit for half the weight and full credit if it has been over a year. This also applies when you first apply for coverage as well. The reason is that many people will gain the weight back quickly after their weight loss, so carriers want to see consistency.

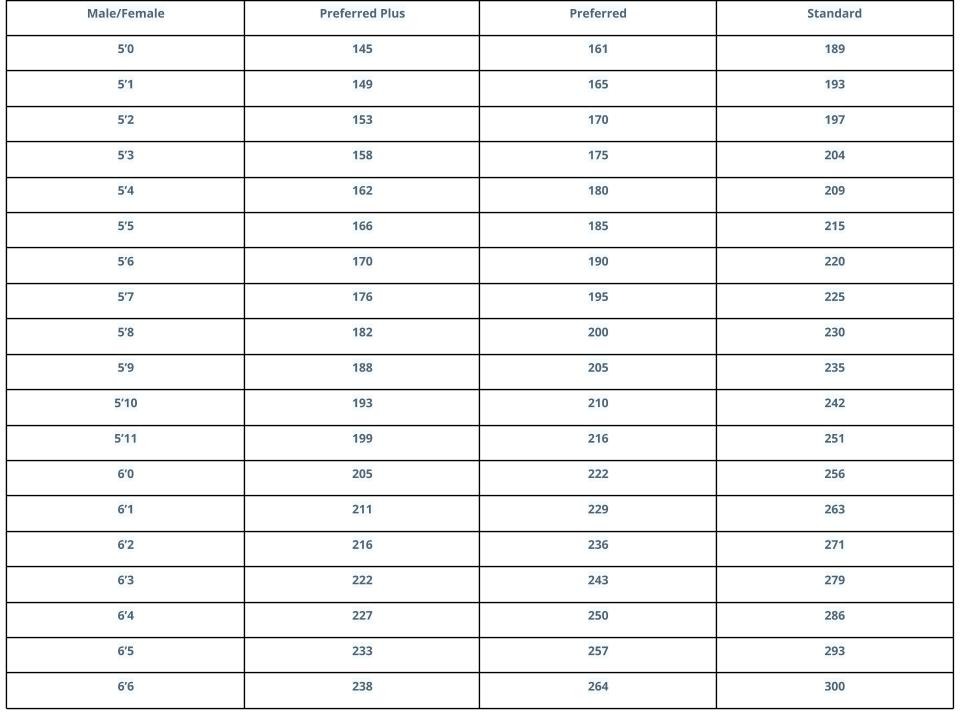

Here is a sample unisex chart to give you an idea if you would like to run a quote with us. Just click here and pick health class that you feel most likely applies to you. Please keep in mind that if you are over the maximum range you will most likely get a substandard rating. In that case, it’s best to get a custom quote by calling us at 888-492-1967.

Getting the best rate if you’re overweight

There are some tings you can do to get a much more competitive rate with higher weight:

- Work with an independent agency to get the better rate. Reason being is that each company has different built charts and it is quite common to get a much better rate if you’re overweight with let’s say Prudential than Protective Life. Also, some companies still offer coverage for people on the higher end of the weight spectrum opposed to not being able to get coverage at all.

- Get a plan that offers lifestyle credits. This is where the company like Banner Life or Principal life will bump you up to a more competitive rate class if you have some positive factors. For example, let’s say that due to your weight you would qualify for a standard rate class but you have no medical conditions, you’re a non-smoker and have no family history of illness. This would qualify you to get bumped up to let’s say standard plus or preferred rate which will make a noticeable difference in the premiums.

- Lose a few pounds before applying because often times we have seen people get rated up higher over 2 or 3 pounds. So find out what is the threshold for certain rate class and see if you can lose the weight first.

Life Insurance that doesn’t require weight

Did you know that there are some policies that don’t ask for your weight and you can get approved without a medical examination? We have a plan through 5 Star Life Insurance Company that can approve you for a no exam policy up to $100,000 regardless of your weight. However, you would have to answer a few health questions and need to be in overall fair health. This plan is also a lifetime term so it is locked in until age 100 so you won’t have to worry about getting any other coverage until then.

Work with Us!

Life insurance shopping can be a breeze if you work with an online broker that has all the carriers and you can compare rates with these companies if you’d like on our quoter. If you’re ready to go feel free to request and application, chat us, call us or email us. Welcome to InsureChance!